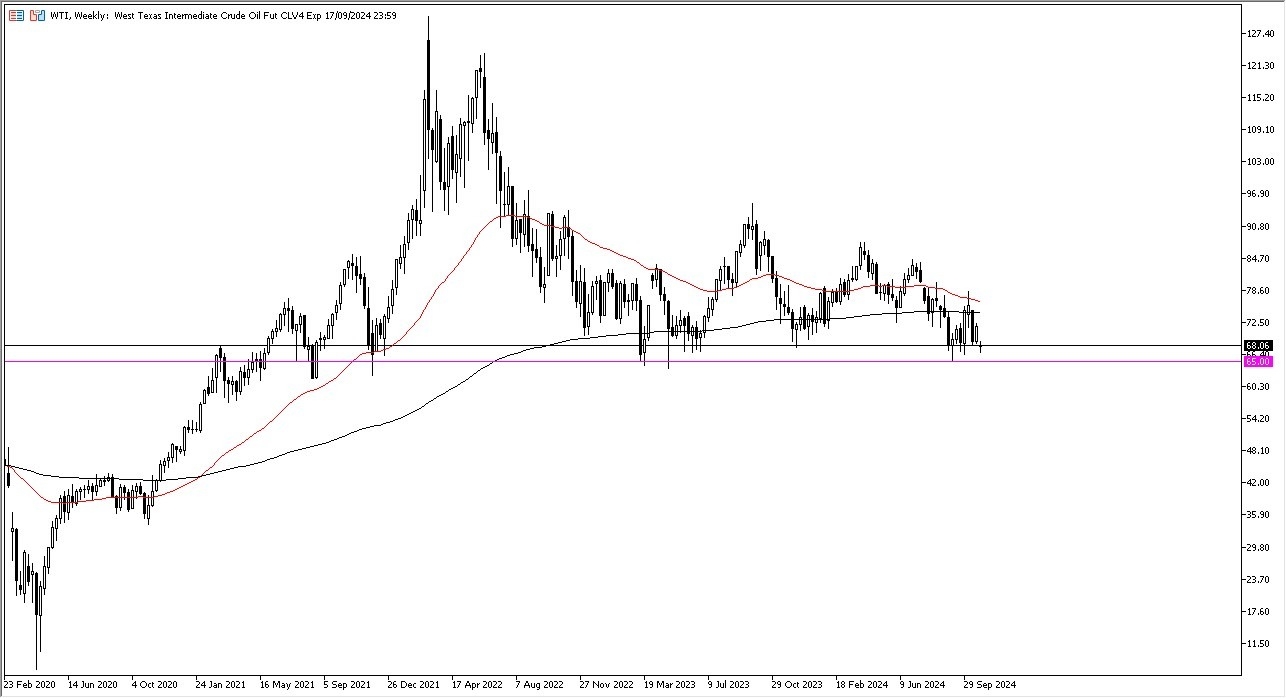

- The West Texas Intermediate Crude Oil market has been noisy and negative during the month of October, but as I write this monthly analysis, it’s worth noting that we are sitting just above a significant support level.

- The support level, which is near the $65 level, goes back a couple of years as far as being important, and therefore I think we’ve got a situation where value hunters are probably coming into this market.

As long as we can stay above the $65 level, I suspect that the month of November might be a bit charitable for the West Texas Intermediate Crude Oil market, but I also recognize that the upside is probably somewhat limited. The main reason is due to the fact that the global economy seems to be struggling, so I think at best what we are looking at is a fairly neutral market for the month of November, and perhaps even further into the future.

Top Forex Brokers

That being said, if we were to close below the $65 level on the daily candlestick, we could see a drop to the $60 level next. This would obviously be a very negative turn of events as far as the market is concerned, and probably could be read through as a serious amount of concern when it comes to the global economy. After all, oil is considered to be the “lifeblood of commerce.” I think the most reasonable expectation would be for a little bit of a bounce, but I don’t necessarily think that we are going to take off and start shooting straight up in the air. The 200 Week EMA sits near the $75 level and is offering a significant amount of resistance.

Keep in mind that the WTI Crude market is more or less US centric, so this is a play on the United States as well. It looks like the economy is doing okay, but to say that it’s strong would be a real stretch of the imagination. I suspect that November will be very much like September and October. The breaking down below the support level at $65 would probably be felt in multiple other markets such as equities and currencies as well.

Ready to trade monthly forecast? Here are the best Oil trading brokers to choose from.