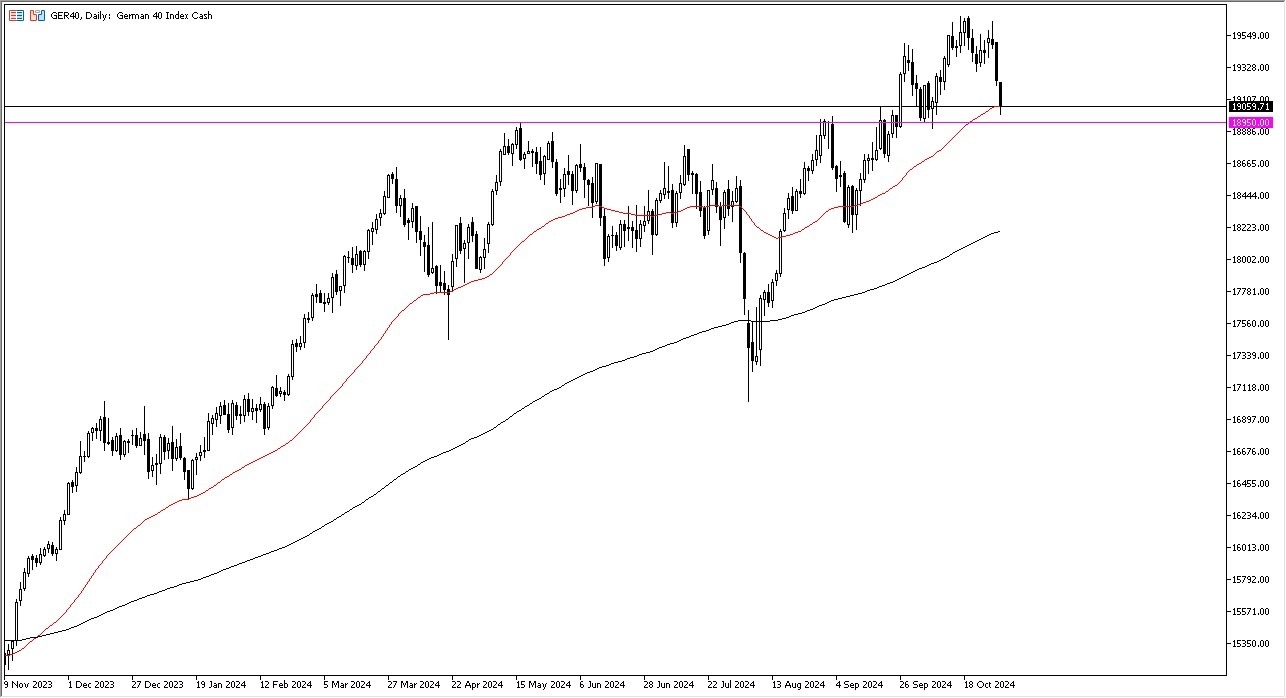

- The German DAX fell during the trading session on Thursday, but it does look like it is trying to hang on to a certain amount of support.

- The 50-day EMA hangs around the same area, and that offers support from a technical analysis standpoint, but we also have the 18,950 euros level offering support, as it was previous resistance, and now it is potential support.

- The fact that we have bounced from there does suggest to me that we have a scenario where we could very well see value hunters coming into the market.

- Keep in mind that Friday is non-farm payroll announcement day in the United States. So, while it doesn't directly affect the DAX, it can have a bit of an influence on risk appetite.

As Goes the DAX, So Goes European Indices and Equities

The DAX is the first place the money goes to in the European Union as far as equities are concerned as Germany is by far the biggest economy. And therefore, this is considered to be the safest index overall. Whether or not that actually plays in its favor remains to be seen, but it certainly looks to me like we are in an area where value hunters would at least be somewhat intrigued. This has been the way most of the year, and despite the recent selloff, I still believe that the market will continue to see this in the future.

Top Forex Brokers

If we were to break down below the 18,950 level on a daily close, then that could signify a little bit deeper of a correction, perhaps down to the 18,500 euros level.

All of this being said, we are still very much in an uptrend, and I don't see anything on here that tells me I should be trying to get short of the DAX, because it will lead the way for the rest of the European Union.

Ready to trade our daily stock market analysis? Here are the best CFD brokers to choose from.