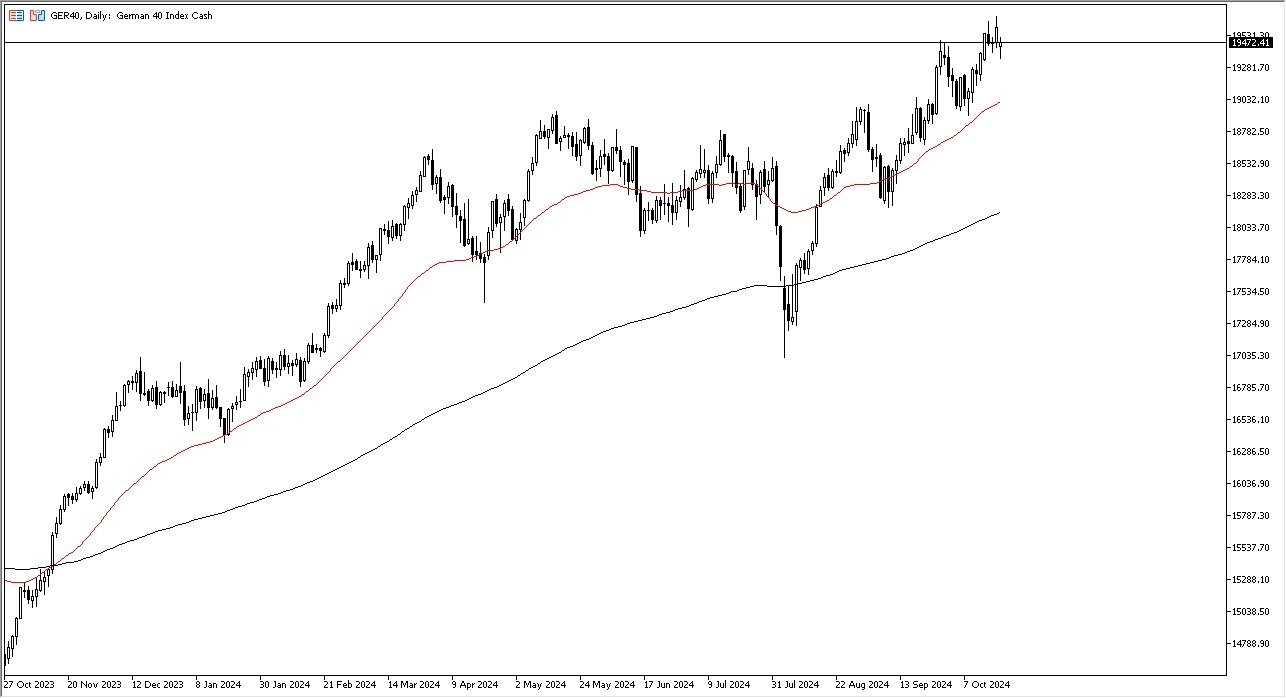

- The DAX initially pulled back just a bit during the early hours on Friday, but you've seen that it has turned around the show signs of life.

- This suggests to me that perhaps the DAX is going to continue to find value hunters willing to jump in.

- In the short term, the 19,300 area should offer support. If we can break down below there, then the 19,000 level gets tested.

In general, I think this is a scenario where we continue to see an uptrend, and I recognize that we have to pay close attention to the DAX due to the fact that it is the leading index in the European Union. With that being said, as the DAX goes, so goes the rest of Europe. As a general rule, the first place money goes to his Germany and then it starts to spread out, in order to take advantage of a bit more “alpha in the market” that you see in places that are smaller economies. In other words, the DAX is considered to be the harbinger for Europe.

Top Forex Brokers

Currency and its Effect on the DAX

The euro itself has been eviscerated and that does help the idea of German exports being cheaper and more affordable to the rest of the world. If we do drop from here, that 19,000 euro level also not only has previous action backing it up, giving it what could be thought of as market memory, but we also have the 50-day EMA hanging around the same area to the upside. If we can break above the recent swing high near the 19,700 level, that opens up the door to the 20,000 euros level, which I do think we try to get there sometime in the next several months, perhaps even by the end of the year, but we are going to continue to see a lot of back and forth and sawing back and forth in order to try to build up enough momentum to continue to the upside.

Ready to trade the daily stock market forecast? Here’s a list of some of the best CFD trading brokers to check out.