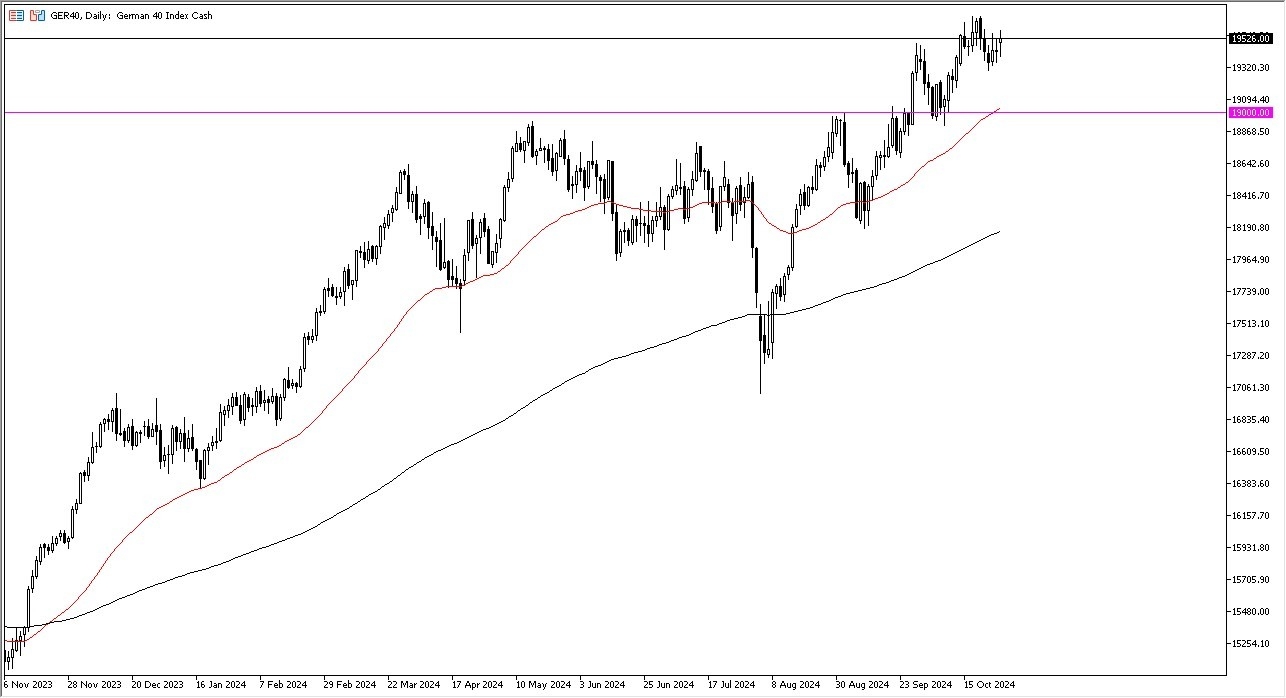

- In my daily analysis of European indices, I am paying close attention to the DAX, as we have seen an initial gap to the upside, only to turn around and show signs of life.

- All things being equal, this is a market that is trying to work off some excess froth from previous momentum and is also hanging around the crucial €19,500 level.

- Short-term pullbacks at this point in time should continue to be an opportunity just waiting to happen, so I do believe that value hunters will continue to be attracted to this market going forward.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair has been bullish for some time, despite the fact that we have seen a couple of choppy sessions. All things being equal, the 50 Day EMA is currently hanging around the €19,000 level, which of course is a large, round, psychologically significant figure that a lot of traders will also pay attention to due to the fact that options markets will obviously have a barrier in that vicinity.

On the upside, we have the €19,650 level offering a significant amount of resistance, and if we can break above there then the market is likely to continue to go much higher.

In that environment, we probably see the DAX index go looking to the €20,000 level over the longer term, and with this I think we have a situation where the momentum will eventually push this index higher. Furthermore, you also have to keep in mind that we have been rising for so long that it is going to take a significant amount of momentum to turn this massive market around.

Furthermore, you need to keep in mind that the DAX is considered to be the “blue-chip index” of Europe, and therefore it makes a certain amount of sense that money will go flowing into it first. Because of this, I always look to the DAX to get a “read on how Europe is doing” in general.

Ready to trade the daily analysis & predictions? We’ve made a list of the best online CFD trading brokers worth trading with.