Potential signal:

- I’m a buyer of the DAX and have no interest whatsoever in selling.

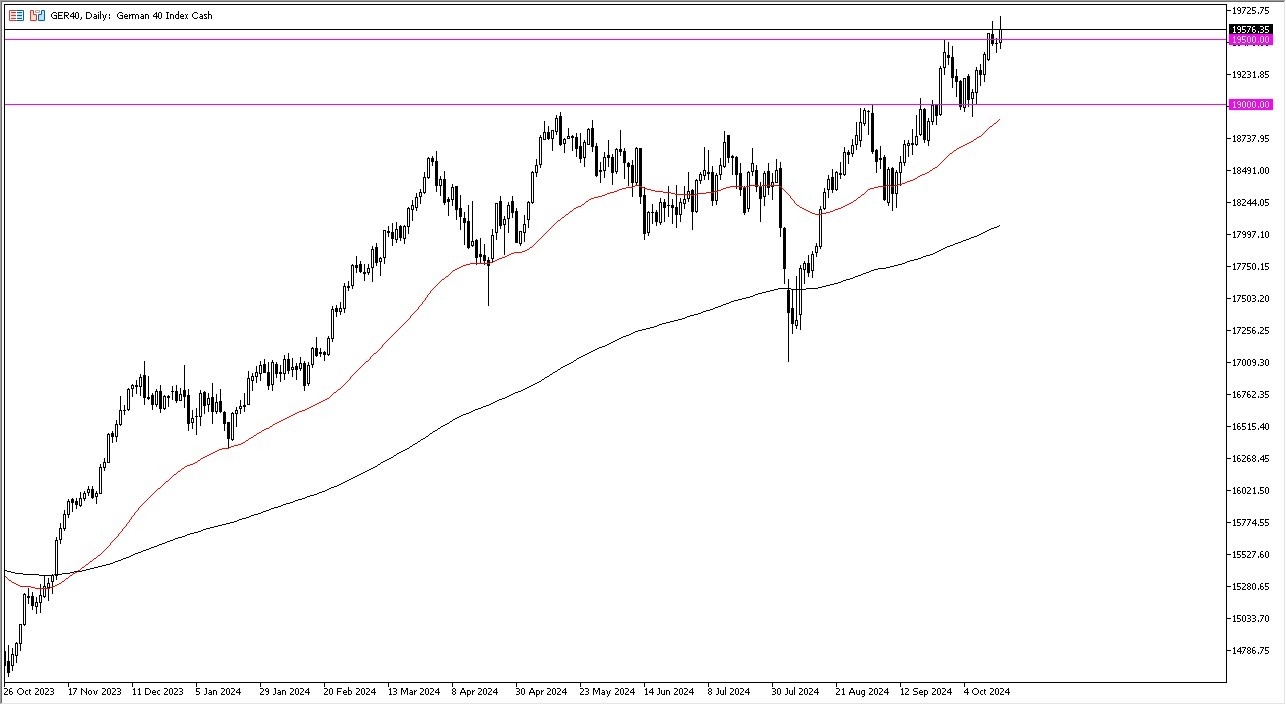

- On a pullback to the €19,500 level, willing to put a position on.

- I am also willing to buy on a fresh, new high at €19,686. I would have a stop loss at the €19,400 level, and at this point I think we are starting to think about reaching the €20,000 level which would be my target.

In my daily analysis of European markets, the DAX stands head and shoulders above all else when I look at the markets, mainly because it is a major driver of where we go on the continent. It is also worth noting that during the trading session on Thursday, we got an interest rate decision from the European Central Bank to cut rates, so perhaps people are starting to look at looser monetary policy is yet another reason to drive stocks higher.

Top Forex Brokers

Remember, a cheaper euro helps Germany as it is a major exporter of large industrial machinery and consumer goods. All things being equal, the DAX has been a major beneficiary of the European Union and the euro itself, and I think that will continue to be the case. The market could pullback from time to time, but quite frankly I think this is a situation where we have plenty of buyers out there willing to get involved.

Technical Analysis

The technical analysis for this market is very bullish, as we at one point during the trading session on Thursday managed to reach a fresh, new high, but it did pull back a bit which makes a certain amount of sense because days where you have the interest rate decision, you typically have a lot of volatility. Nonetheless, it’s worth noting that the €19,500 level now looks as if it is broken to the upside and therefore, I think it’s probably a scenario where any time we pull back, there should be plenty of buyers willing to take advantage of value, and therefore looking for “cheap contracts.”

Underneath, we have the €19,000 level offering a massive “floor in the market”, as the 50 Day EMA is racing toward that area as well, and it has shown itself to be important more than once. With that being said, I am bullish of this market, and I think that if we do get any type of stability, it makes a certain amount of sense to get involved in this market.

Ready to trade our daily forex signals? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.