- The Euro initially pulled back just a bit during the trading session on Tuesday, only to turn around and show signs of life.

- By doing so, the market is likely to continue to see a lot of noisy behavior.

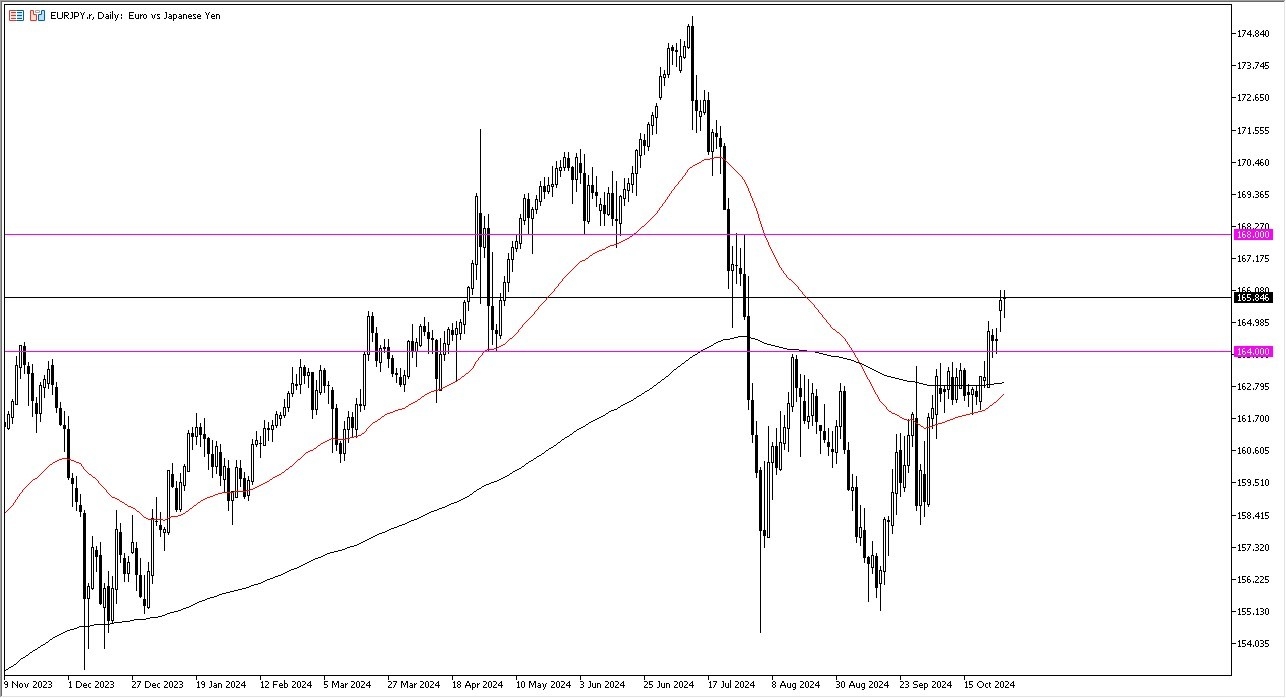

- I think ultimately this is a situation where the 164 Yen level underneath will continue to be a significant area of interest as it was previous resistance and now should offer support based on market memory.

Keep in mind that the Bank of Japan has an interest rate decision on Thursday, and this of course will have a major influence on what happens next, but the Bank of Japan has already admitted that it can't do much as far as tightening monetary policy. So, I think you will continue to see the carry trade come back to life.

Top Forex Brokers

Carry Trade Continues to Drive this Pair Despite Euro Weakness

While the euro is not necessarily my favorite currency, it's not as bad as the Japanese yen. And it's worth noting that you are speaking of relative strength, not strength. Those are two different things. The market could rally to the 168 yen level above where I see a massive amount of market memory just waiting to cause issues. Right now that's my target. With all of the noise between here and there on the charts and of course the Bank of Japan interest rate decision, I do think it's going to be a very messy move to that level, but I do think it happens given enough time.

For what it is worth, the 50-day EMA is starting to curl higher, and it looks like it wants to cross above the 200-day EMA, kicking off the so-called Golden Cross. While I'm not a huge advocate of this signal, it is something worth noting for longer-term traders. I’m not a big fan of it, but that being said I know that a lot of the longer-term “buy-and-hold traders” will pay attention to it.

Ready to trade our daily forex forecast? Here are the best forex brokers in Japan to choose from.