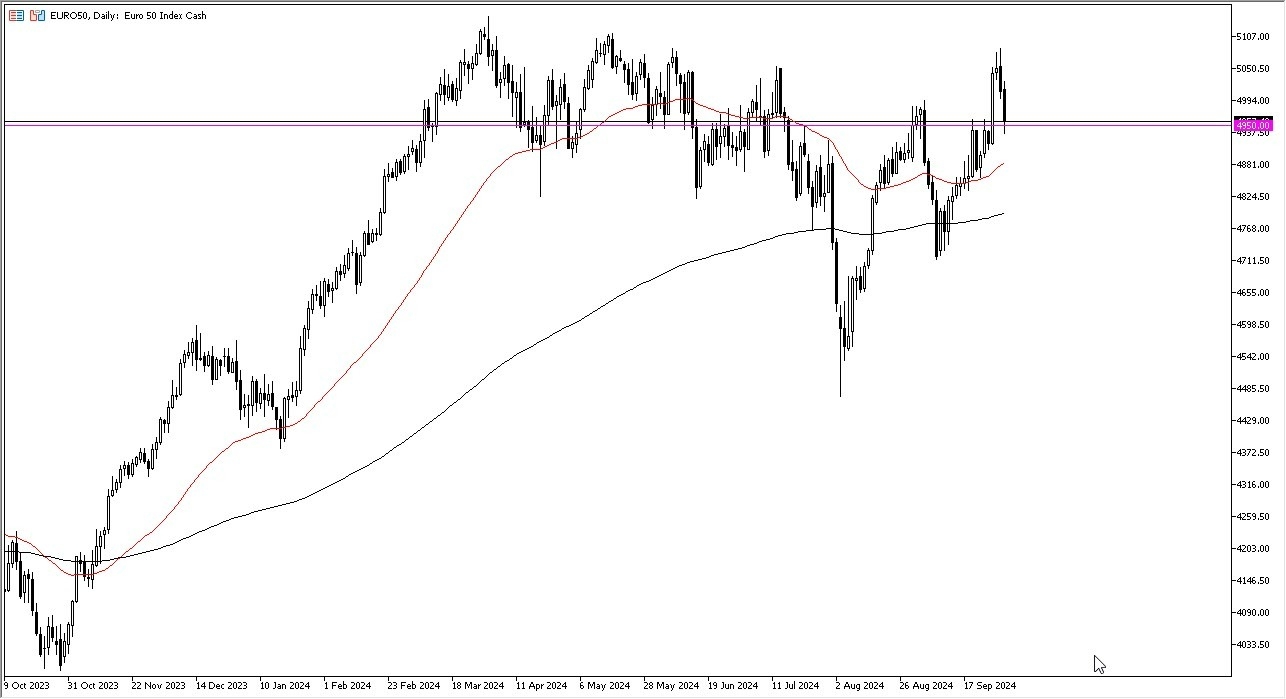

- The Euro Stoxx 50 fell rather significantly during the trading session on Tuesday, which is not a huge surprise considering that CPI is now below the 2% target that the ECB dictates.

- So, what this suggests is that perhaps there is a bit of a sluggish outlook for the European economy, and therefore I think we have the reaction that you would expect.

- Furthermore, in general, we've seen more or less a negative reaction across stock markets around the world and I do think that this pullback, as I said, makes a certain amount of sense not only from a fundamental standpoint, but from a technical one as well.

Looking at the technical analysis we had recently broken out, but then started to reach an area that has had a lot of resistance more than once. With this being the case, the market dropping towards the 4950 euros level makes sense. It was an area that previously had been resistant, and it now looks as if it's offering support. Clearly, this index will go as Germany goes overall and of course France, but at this point in time, I think this was value that needed to be presented. After all, there's no point in chasing the market higher. And we got our first glimpse of that on Monday when the market initially took off to the upside but then closed lower. At this point, it does seem like we're in an area where you would expect a certain amount of market memory and support to come in to push the Euro Stoxx 50 higher.

Top Forex Brokers

This Index Could be Offering Value

This index could be offering value on dips, and I think at this point in time it’s very possible that we could see buyers come back in and start buying. After all, even though the CPI numbers were weaker than anticipated in the European Union, the reality is that the ECB will be more likely to come in and support economic growth in that environment, assuming that this is just a bit of a statistical anomaly, which brings to mind the phrase that “one data point is not a trend make.”

Ready to trade our daily forex forecast? Here are the best CFD stocks brokers to choose from.