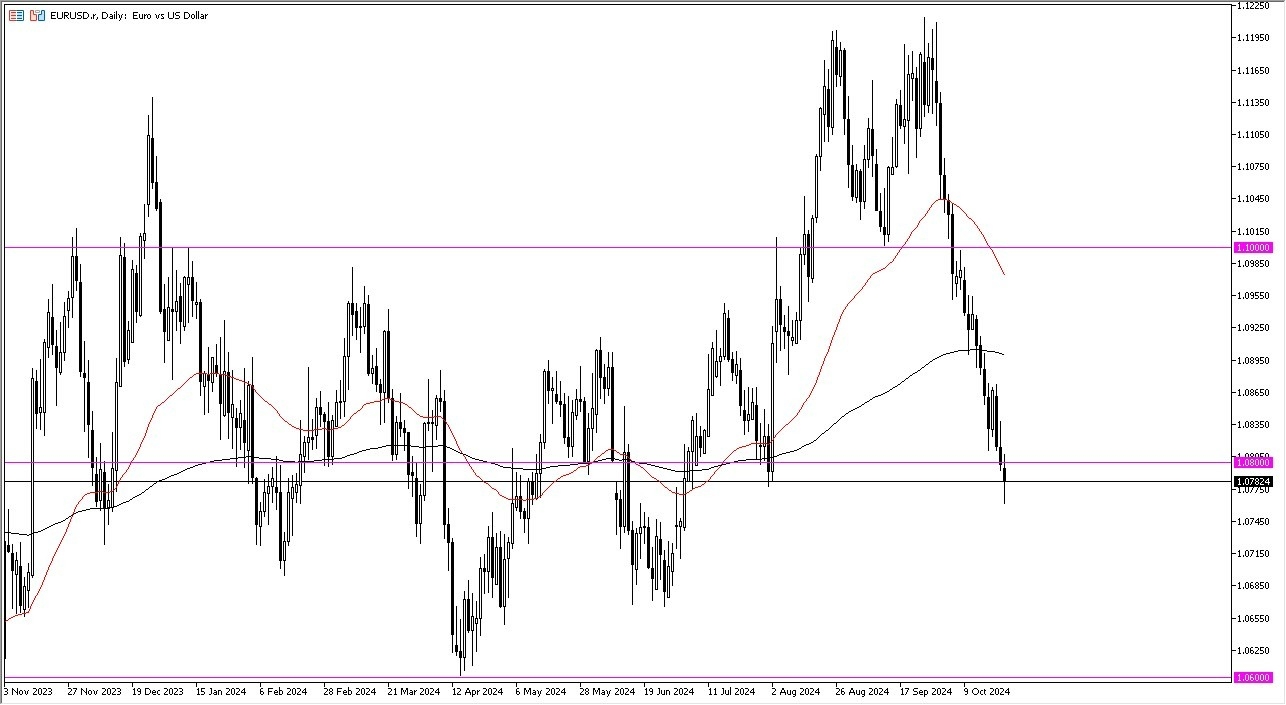

- The Euro was fairly noisy during the early hours on Wednesday as we continue to dance around just below the 1.08 level.

- By doing so, it looks like we are starting to struggle yet again and breaking down below the 1.08 level is a big deal.

- The question now is whether or not we continue to free fall from here. I suspect it all comes down to the bond market and what things are happening there as interest rates continue to climb despite the fact that the Federal Reserve is trying to knock them back down.

- At the end of the day, the bond market has more influence for the longer-term move.

Federal Reserve Continues to Look Lost

In other words, there is a real concern that the Federal Reserve is about to lose control of the bond market, and if that's the case, things could get wild. At this point, a turnaround is possible, though. We do have PMI numbers coming out of Germany and the United States during the trading session, but I think that Thursday's probably going to be a question of whether or not we can recover. The 200-day EMA sits right around the 1.09 level, and it's not until we break above there that I would consider buying this pair. Between now and then, we could see a little bit of a rally, only to see exhaustion and start selling again.

Top Forex Brokers

Keep in mind, there's also the risk appetite part of the equation, because if risk appetite starts to fall apart, then the US dollar typically attracts a lot of inflows via the treasury market. Keep in mind that as rates go higher and people are concerned about the world, they will typically need to buy US dollars in order to get involved in the bond market, which is exactly what we are seeing right now. If this continues, the US dollar will become a major issue for not only this currency, but most markets around the world to begin with.

Ready to start trading the EUR/USD daily analysis? Get our top rated Forex brokers list here.