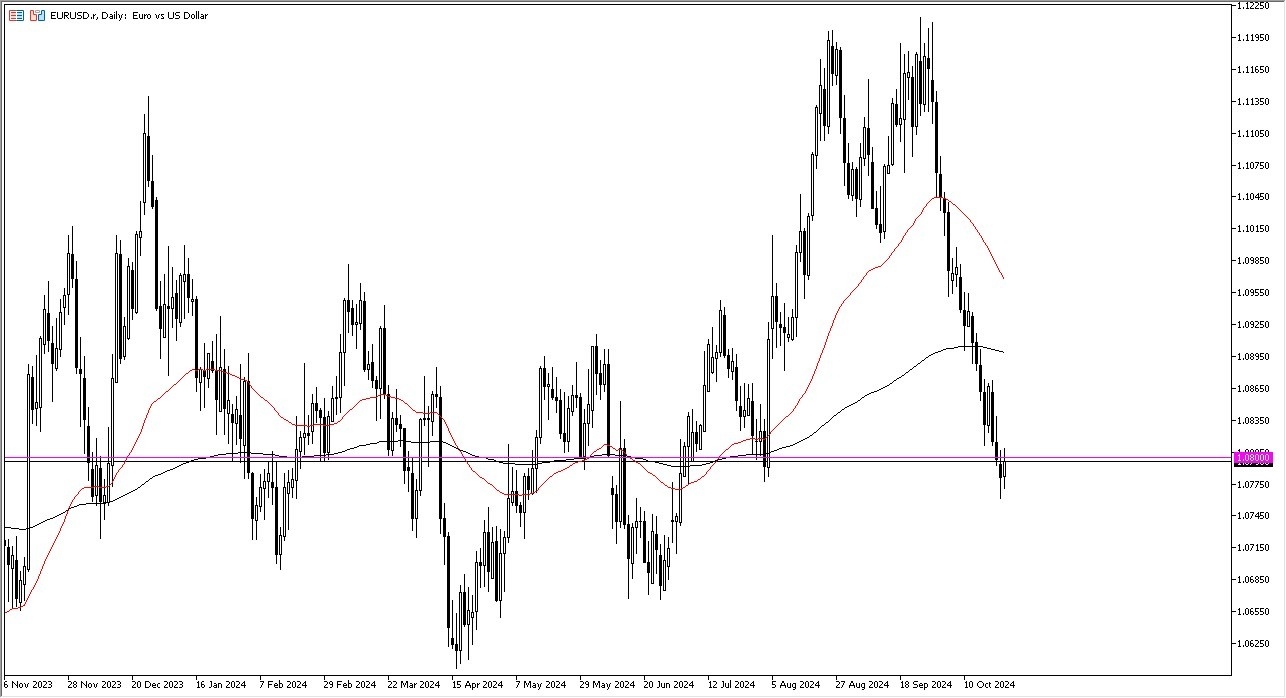

- My daily analysis of the EUR/USD pair, the market is likely to continue to see a lot of volatility in this area as the 1.08 level is an area that is a large, round, psychologically significant figure, and an area that we have seen a lot of noise previously.

- It is worth noting that the 1.08 level has a lot of “market memory” attached to it, and therefore we need to pay close attention to what the next move is.

As things stand now, the euro has absolutely fallen apart over the last couple of weeks, dropping 400 points. In fact, we dropped 400 points in almost a straight line. All things being equal, the 1.08 level has so far offered a certain amount of support, but it is worth noting that we are oversold, and therefore I think you’ve got a situation where a bounce could very well happen, but I think that bounce is going to end up offering a nice opportunity to start selling again, if we can show signs of exhaustion.

Top Forex Brokers

Technical Analysis

The technical analysis for this currency pair is pretty dire, but with the oversold condition I think it would be a bit foolish to start selling here. This isn’t to say that we can go lower, just that the market could offer you a little bit better of an intrigue, especially if the PMI numbers in the United States come out cooler than anticipated late in the day.

I would look at the 200 Day EMA above, as a potential resistance barrier that could kick off a nice shorting opportunity at the first signs of exhaustion. This of course suggests that we can even get to that area, but all things being equal, this is a market that continues to look at the interest rate differential, especially as the 10 year yield continues to be climbing, so that helps the US dollar as money is treated much better in the United States that it is the European Union as far as the bond markets are concerned. With this, I remain varies but I also recognize that we need to get a better entry point.

Ready to trade our daily EUR/USD Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.