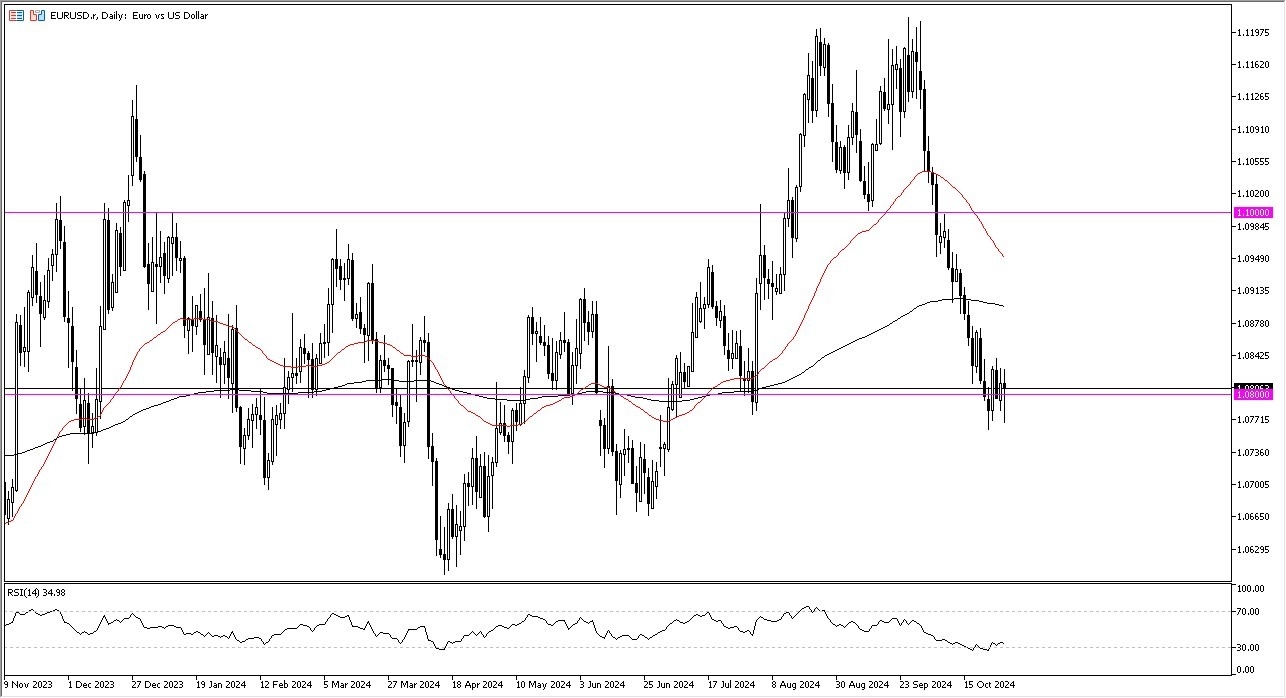

- During my daily analysis of the EUR/USD pair, I can see that the 1.08 level continues to be important.

- This is a significant level that a lot of people will be paying attention to, due to the fact that the market has reacted to this level multiple times in the past.

- With that being the case, I do like the idea of picking up a little bit of a small position if we do in fact break out from here, due to the fact that the market could very well see this as a correction to an oversold condition.

All of that being said, you also have to keep an eye on interest rates in the United States, due to the fact that the interest rates have spiked over the last couple of weeks, which has driven the US dollar higher.

Top Forex Brokers

Furthermore, we have had quite a bit of confusing economic announcements as of late, as it gives the Federal Reserve plenty to think about. In general, I think that there is a certain amount of risk appetite that needs to be taken into account when you are looking at this pair as well, so therefore be cautious and recognize that this is a situation where you could find quite a bit of noise getting in the way.

Technical Analysis

The technical analysis for the EUR/USD currency pair is rather choppy and noisy, but I do think it is probably only a matter of time before we see the buyers try to come in and push this market higher. After all, the market is certainly looking as if it is trying to recover, and the last several days have been somewhat stagnant. While that isn’t necessarily an extremely bullish sign, considering just how far we fell to get here, it’s at least the start.

Ultimately, I think we are essentially stuck in a 100 point range right now, so we can break above the 1.0850 level, that could be an opportunity for buyers to come in and take advantage of momentum. On the other hand, if we were to break down below the 1.0750 level, then the market could fall apart from there. In that environment, I think you would probably see the US dollar strengthen against almost everything.

Ready to trade our Forex daily analysis and predictions? Here are the best European brokers to choose from.