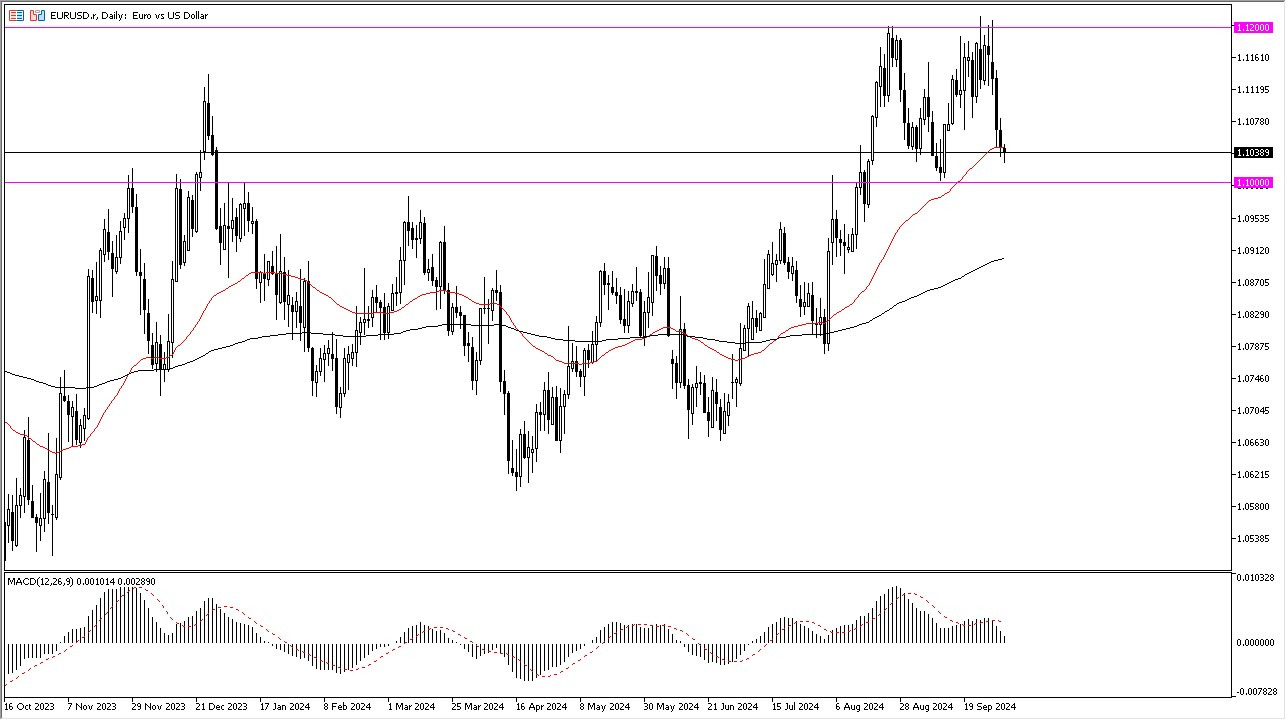

- The Euro initially did drop a bit during the early hours on Thursday, but really at this point in time, the 1.10 level underneath continues to be the main area of interest as the marketplace does tend to go back and forth between the same large round figures.

- As long as that's going to be the case, I'm not really going to change my opinion or tactics much.

- Really at this point, I think we probably get a little bit of a bounce.

I don't necessarily think that it's going to be a massive one, but I do recognize that we are in an area that, more likely than not, will continue to attract attention. On a rally from here, the 1.12 level could be the target, which is probably worth noting as a major resistance barrier going back all the way to the beginning of 2022.

Top Forex Brokers

The market pulling back the way it has during the week does suggest that perhaps we are not ready to go to the upside and that would make a certain amount of sense I suppose because both central banks are likely to be cutting rates, and I don't see how that changes much.

ECB and Fed

The ECB already has cut a couple of times and now the question is with CPI in the European Union, perhaps coming under its target even more than it's no longer an inflationary situation. It's a question as to whether or not the ECB will have to stimulate and if that ends up being the case that obviously will work against the euro. The Federal Reserve has cut 50 basis points and that was a bit shocking. We saw the Euro rise higher because of it. But now the question is, how much further do they have to cut? Probably have to wait and see on that one, but I think at this point, we're just going back and forth between major round numbers. 1.10 underneath is massive support. 1.12 above is massive resistance.

Ready to trade our daily EUR/USD Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.