- During the month of October, we have seen the euro fall hard against the US dollar.

- mainly due to the fact that interest rates in the United States continue to climb. With this being the case, the market is likely to continue to pay close attention to that bond market, but November has a little bit of a crinkle here, in the form of a US Presidential election.

- Because of this, I do expect a lot of volatility during the first week of November, but at the end of the day it probably won’t change much.

- I know this is heresy when it comes to political discourse in the United States, but I think we have already seen traders trying to price in the idea of a new Donald Trump administration, at least that seems to be the way that Wall Street is pricing everything.

As Wall Street goes, so goes the rest of the trading environment. It is because of this that I think the most disruptive potential event in November might be a Kamala Harris win. After all, if traders are leaning in one direction and they get a completely different result, it does tend to cause a lot of chaos. All one has to do is look at the Donald Trump when in 2016 to see what kind of volatility that can cause.

Top Forex Brokers

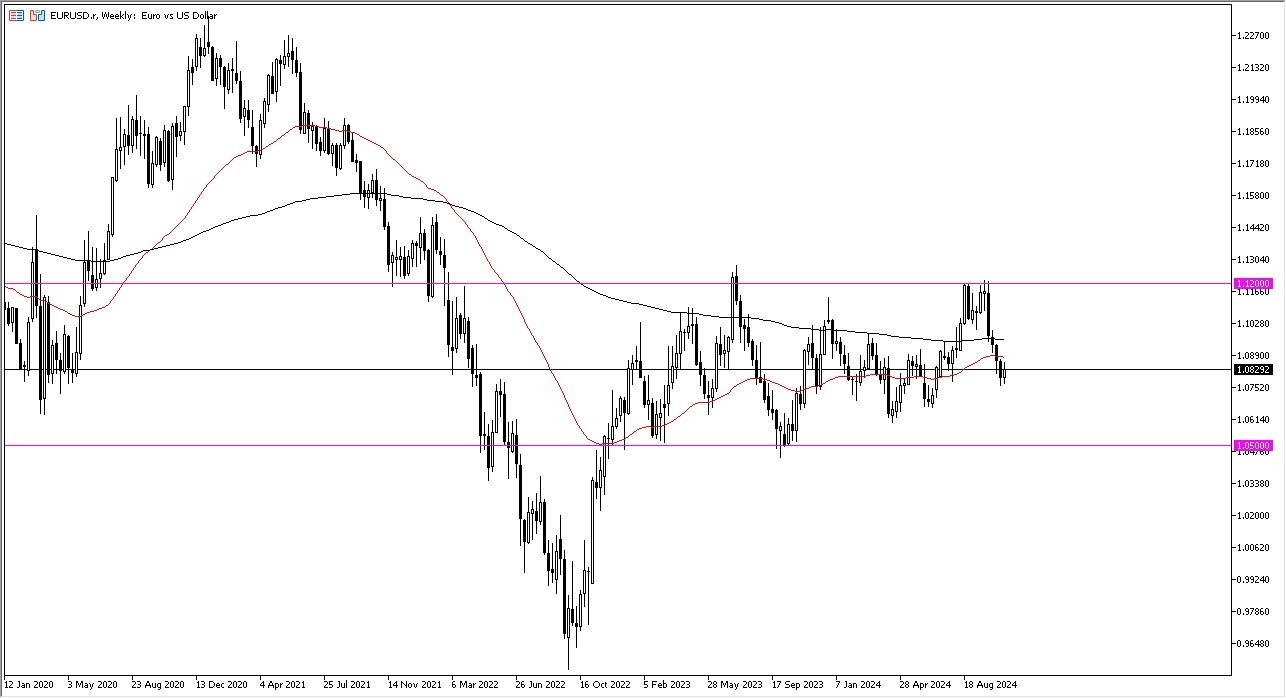

That being said, even if we get that disruptive event, I suspect that the market will only be crazy for a day or so. The overall attitude of the market is still one that is in the middle of the larger consolidation area, which stretches all the way from the 1.05 level underneath and the 1.12 level above. Furthermore, it’s worth noting that the 50 Week EMA is somewhat flat, and of course we have the 200 Week EMA as well. In other words, this is a situation where we will more likely than not continue to bounce around in this general region.

Overall, I think this is a market that will remain somewhat neutral from the longer-term standpoint, but it would not be overly surprising to see the euro gained slightly for the month. That being said, if the market were to break down below the 1.07 level, then I think the euro will have to fall down to the 1.05 level underneath to look for support.

Ready to trade our monthly forecast? We’ve made a list of the best European brokers to trade with worth using.