Potential Signal:

I am a seller of this market under 2 conditions. The first one would be a breakdown below the 1.0750 level, in which I would be aiming for the 1.06 level, with a stop loss at the 1.0820 level. The other one would be if we do rally to the 200 Day EMA and form a long wick to the upside. At that point, I would be aiming for the 1.0750 level, with a stop loss at the 1.0940 level.

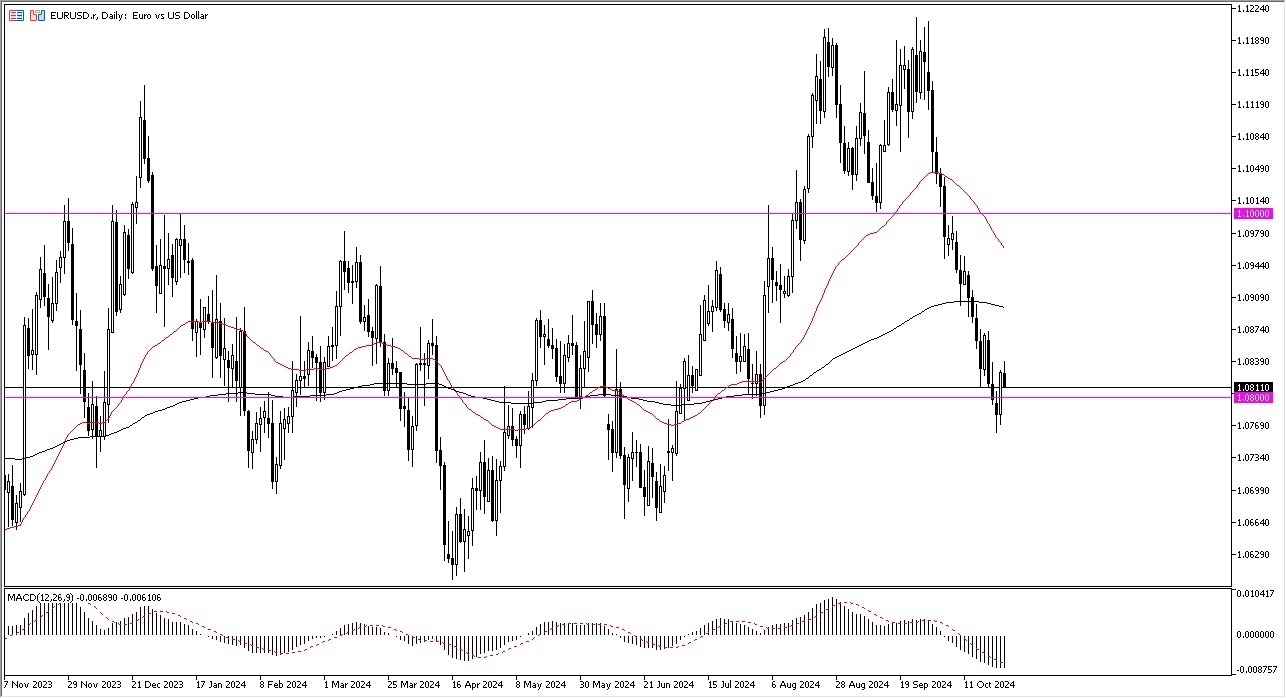

In my daily analysis of the EUR/USD currency pair, the first thing I noticed was that we did try to rally a bit but gave back the gains in order to show signs of weakness. This contrasts quite drastically with the massive candlestick that we saw during the trading session on Thursday, as we bounced well above the 1.08 level.

Because of this, the Friday candlestick does tell you that there isn’t any real conviction in owning the euro at the moment, and therefore I think we’ve got a situation where we continue to look for “cheap US dollars.”

Top Forex Brokers

Technical Analysis

The market hang around the 1.08 level suggests that we are going to continue to test whether or not the bottom will hold in the market. At this point, if we do see another run to the downside, we could very well see a lot of downward pressure, and probably a huge run higher in the US dollar against most currencies.

On the one hand, if we were to turn around a break above the 1.0850 level, then the market is likely to go looking to the 1.0875 level, an area that has been important multiple times. If we can break above there, then the market is likely to go looking to the 200 Day EMA, which is right around the 1.09 level. That’s an area that I think will continue to be important, and I would be paying close attention to if we see any signs of exhaustion after a bit of a bounce.

On the other hand, if we break down below the lows of the last couple of days, the market could drop down to the 1.06 level rather quickly. Furthermore, you would probably see the US dollar strengthening against most other currencies around the world, not just the euro. Keep in mind that the euro against the US dollar is the biggest market out there when it comes to currencies, so gives you an idea as to how the US dollar should trade on the whole.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best forex brokers in Europe to check out.