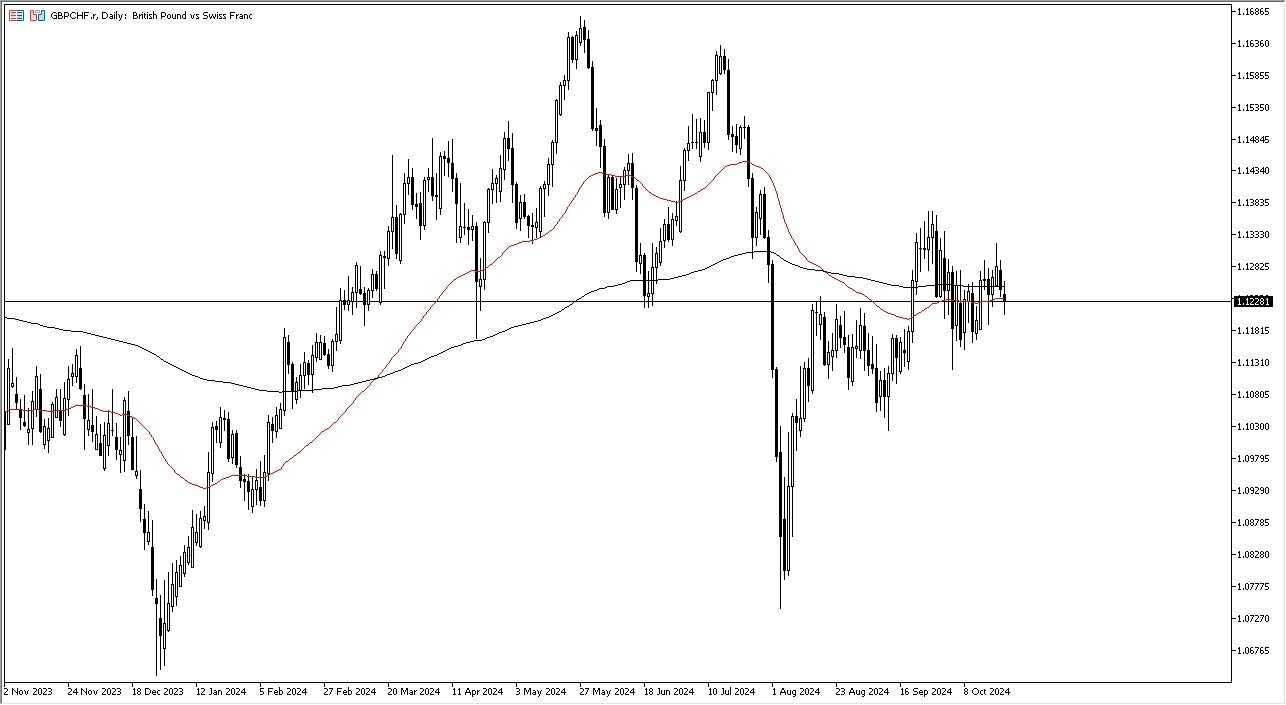

- During my daily analysis of the GBP/CHF pair, the market looks very sideways, I think that will probably continue to be the case over the next couple of days.

- After all, we get PMI numbers coming out of the United Kingdom, which could be the next big move or, but I don’t really see anything on the calendar that pertains to Switzerland, so let’s of course we got some type of economic shock or perhaps even a geopolitical one, this is a market that’s just simply waiting for some type of news to bet on.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is about as neutral as it gets. However, I would also point out that the last couple of lows have been higher, so I do think that we are just simply killing time in digesting the move to the upside. If we can break above the 1.13 level, then I think you have a shot at the market going higher. Keep in mind that the interest rate differential does favor the British pound, and I think that is one thing that you have to keep in the back of your mind. It is not unless we get some type of “risk off behavior” in the markets that I think this is a market that you need to be thinking about shorting.

Longer term, I do believe that the interest rate differential continues to favor this market going higher, so if you are comfortable with a small position and simply looking at it as an investment, this might be the market for you. However, if you are a shorter term trader, then you will probably use something along the lines of a Stochastic Oscillator to time the market back and forth, carving out little bits and pieces along the way. For myself, I like the idea of investing and simply collecting swaps at the end of every day, but I would not get heavily involved in this market at the moment, despite the fact that it is actually one of my favorite pairs.

Ready to trade our daily GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.