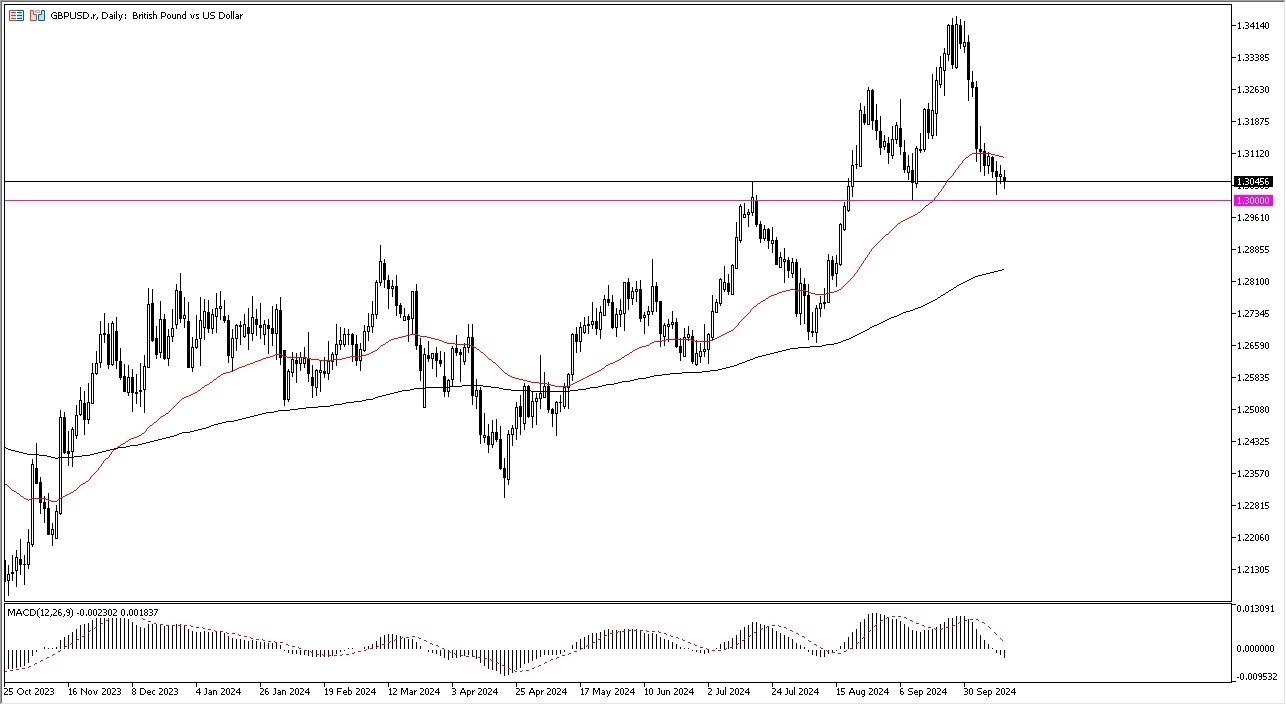

- During my analysis of the GBP/USD pair, I noticed that the British pound has gone back and forth during the course of the trading session on Monday, as we continue to see the British pound try to test the 1.30 level as massive support.

- All things being equal, this is a situation where traders are jumping into the market in order to defend the 1.30 level, as it has been important multiple times.

Technical Analysis

The technical analysis of the GBP/USD pair continues to see a lot of sideways action just above the 1.30 level, which of course is a large, round, psychologically significant figure, and an area where we have seen a lot of action in the past. All things being equal, the market will continue to look at the 1.30 level as important due to the fact that there had been a lot of selling pressure there previously.

Top Forex Brokers

The 50 Day EMA sits near the 1.3112 level and is dropping, as it is sitting just above current trading. If we were to break above that level, then it would open up the possibility of a move higher, perhaps to the 1.3250 level, and then the 1.34 level. Because of this, I think that if we were to break above these 2 obvious resistance barrier, then it’s likely that we would see a bit of “FOMO trading” enter the picture.

On the downside, if we were to break down below the 1.30 level, then the market could drop down to the 200 Day EMA, near the 1.2850 level underneath.

This is a market that has been sold off rather aggressively until the last week or so, so this does create the idea that the market may find plenty of buyers.

However, if we were to break down below that area, I think then you have to look at the US dollar through the prism of all of the major currencies, because quite frankly if we see the British pound start to sell off, then it makes a lot of sense that the US dollar would be strengthening against most of its counterparts.

Ready to trade our Forex daily analysis and predictions? Here are the top UK forex trading platforms to choose from.