- In my daily analysis of major currency pairs, the GBP/USD pair has shown itself to be resilient, after initially dipping, only to turn around and show signs of life again.

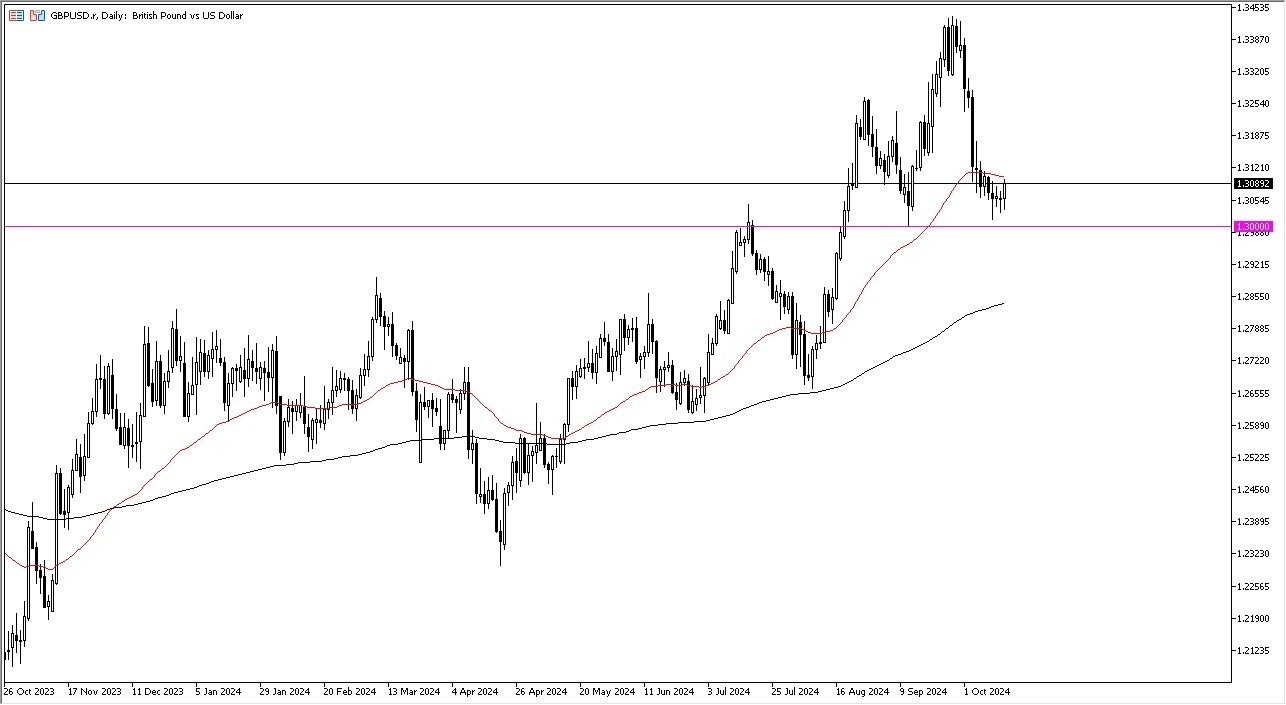

- By doing so, the market looks like it is going to continue to see the 1.30 level underneath as significant support.

- The 1.30 level of course is a large, round, psychologically significant figure, and an area that we have seen action at previously. Because of this, the market is likely to see a lot of “market memory”, which is the phenomenon where the same levels continue to push markets around.

Ultimately, the British pound could be a big winner against the US dollar, as the interest rate differential is essentially nonexistent, and therefore it is more or less a player on which direction these 2 economies are going. After all, we already know that the Federal Reserve is likely to continue to see reasons to cut rates over the next several months, and despite the fact that the economic news coming out of the United States has been a little bit better, most traders believe that the Federal Reserve will cut another couple of times between now and the middle of next year. On the flip side of this, the Bank of England really hasn’t shown a whole lot of interest in doing so yet, although they probably will as well before it is all said and done.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is intriguing, because not only does the 1.30 level look likely to offer some support, but we also have the 50 Day EMA sitting just above, which could be the gateway to higher levels. If we break above there, then we could see this market travel all the way to the 1.34 level. On the other hand, if we were to break down below the 1.30 level, then it opens up the possibility of a drop toward the 200 Day EMA, which is currently sitting near the 1.2850 level.

Keep in mind that the Consumer Price Index numbers come out of Great Britain on Wednesday, as well as Retail Sales on Friday. On Thursday, we have the Americans releasing Retail Sales, and the weekly Unemployment Claims numbers, all of which could cause some volatility in this market.

Ready to trade our daily GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.