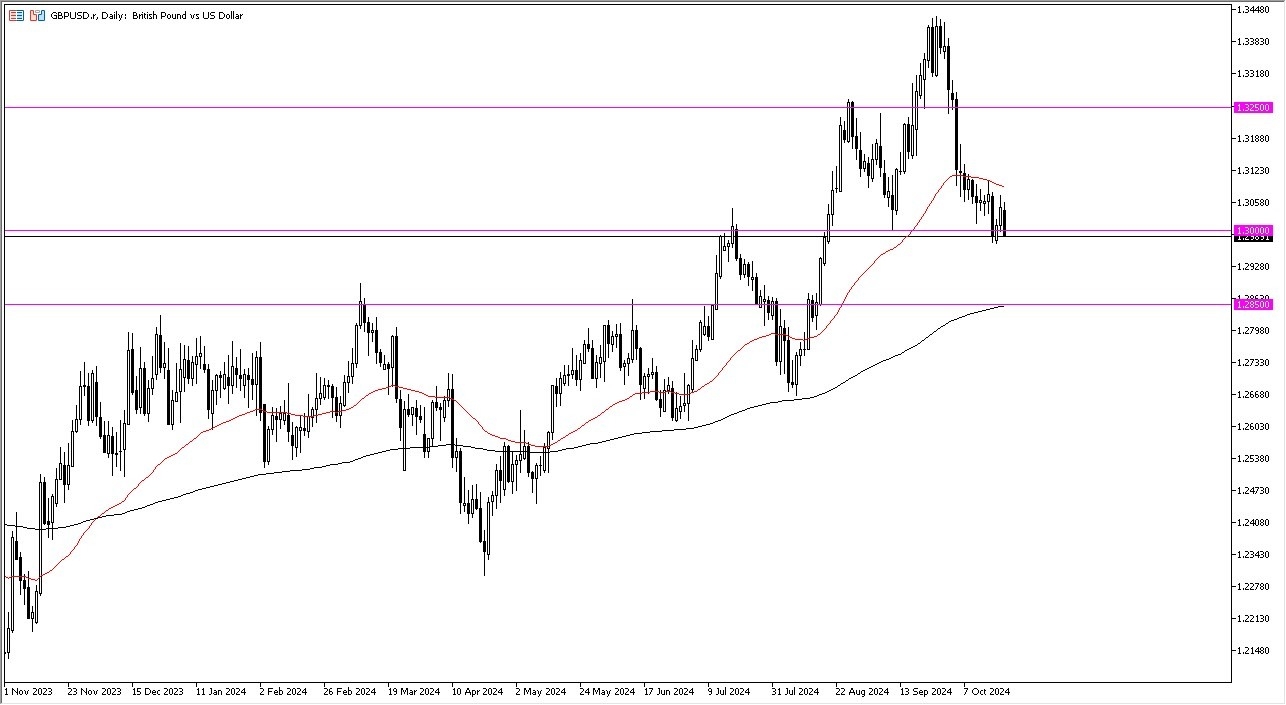

- The British Pound initially rallied just a bit during the early hours on Monday, only to give up the gains and fall apart.

- At this point, the market is testing the 1.30 level, which of course is a large round psychologically significant figure.

- This is an area that's also seen a lot of market memory in the past, and therefore I think you've got to look at this through the prism of whether or not we continue to break down.

If we do, and it certainly looks like we're going to at least try, then it's very possible that the British Pound could drop down to the 1.2850 level, which happens to be where the 200-day EMA comes into the picture. Keep in mind the 200-day EMA is of course going to be an indicator that a lot of people pay close attention to when it comes to the overall trend. That being said, I am also the first to admit that it isn’t the “be-all-end-all” of reasons for the market to move.

Top Forex Brokers

On a Turnaround in this Pair

On the other hand, if we turn around and bounce from here, we could see the 50 day EMA offering a bit of resistance. And if we can break above there, then the market is probably going to continue to go towards the 1.3250 level. This market of course is going to have a certain amount of risk appetite trading involved in it, because of course the US dollar is considered to be the ultimate safety currency.

The British pound, although not necessarily risky, is further out on the risk spectrum than the green bank. So therefore, if people are likely to continue to see more of a risk on type of behavior, then the British pound is more likely than not going to continue to the upside. I would wait for a move above the 50 day EMA to start buying just simply because it would then tell us that we have enough momentum to continue going higher.

Ready to trade our daily GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.