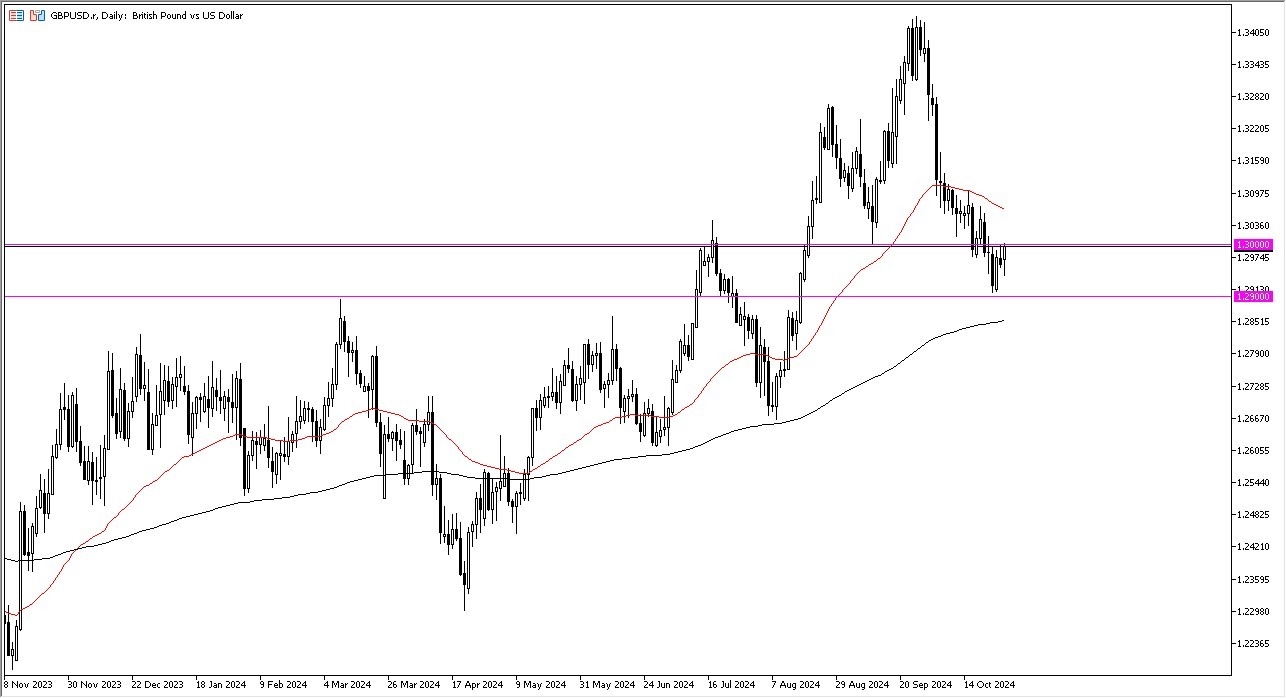

- During my daily analysis of the GBP/USD pair, the first thing I see is that there has been a lot of volatility in this market.

- That’s not a huge surprise, considering that we are hanging around an area that has been technically important multiple times.

- With this being the case, and the fact that the market could not break cleanly above the 1.30 level, it leads me to believe that this pair will continue to be somewhat neutral in the short term.

This may not be a huge surprise, simply because the week will feature the employment numbers coming out the United States, and the Non-Farm Payroll week always tends to be a little bit noisy. Nonetheless, I do think that there is a certain amount of support underneath and it’s likely that this pair will continue to find value hunting, especially near the 1.29 level as we have seen multiple times.

Top Forex Brokers

Technical Analysis

It’s worth noting that we are hanging around the 1.30 level, because one would have to assume that there are a lot of options barriers there. If we can break above this number, then it’s possible that we could go looking to the 50 Day EMA, which is right around the 1.3050 level.

Anything above there, then I would become much more bullish of the GBP/USD exchange pair. I don’t necessarily think it’s easy to make happen, but I would not be surprised at all to see this scenario play out.

Underneath, we have the 1.29 level offering support, but below there we have the 200 Day EMA which is closer to the 1.2850 level.

Breaking down below that level opens up the trapdoor for much more selling pressure, and I think at that point in time you could see this market drop all the way to the 1.26 level, but more importantly you would probably see the US dollar strengthening against almost everything. After all, the US dollar does tend to move in the same direction against most currencies.

Ready to trade our Forex daily analysis and predictions? Here are the top UK forex trading platforms to choose from.