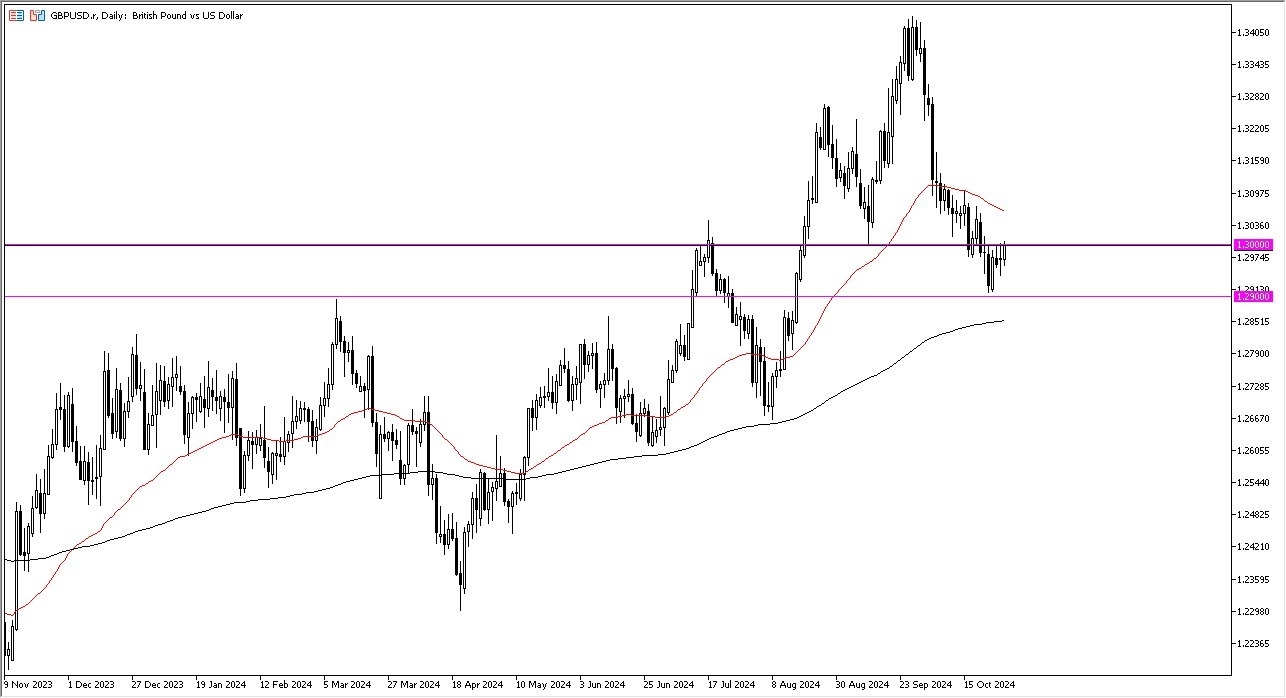

- During my daily analysis of the GBP/USD pair, I’m watching the 1.30 level with a lot of interest, as this is an area that has been important multiple times in the past.

- Quite frankly, the market loves these large, round, psychologically significant figures, and the fact that we continue to test it suggests that perhaps we could see a little bit of a rally from here, but we obviously need to see more momentum enter the market to get truly convinced.

Top Forex Brokers

Technical Analysis

The 50 Day EMA is sitting near the 1.3070 level and is in fact dropping.

Because of this, there should be a certain amount of resistance built into the market, and if we can break above there, it would obviously be a very bullish sign for the the GBP/USD exchange pair, and we would probably see it really start to take off toward the upside, perhaps reaching the 1.34 level before it is all said and done.

However, it’s also worth noting that the market has seen quite a bit of selling pressure as of late, and although the last couple of days have been more or less about stabilization, the market has reached as low as the 1.29 level, and that type of move cannot be ruled out from happening again.

Ultimately, I think this is a scenario where we have some work to do before we can get overly excited about the idea of buying this pair. If we were to break down below the 1.29 level, suddenly we are starting to look at the 200 Day EMA as the last vestige of support for this currency pair.

The bond markets in America continue to see rates spike, which of course is one of the biggest problems right now. As long as that is a bit of a problem, we will probably see a lot of noise when it comes to the US dollar overall, and this pair of course will not be immune to it.

Ready to trade our Forex daily analysis and predictions? Here are the top UK forex trading platforms to choose from.