Potential Signal:

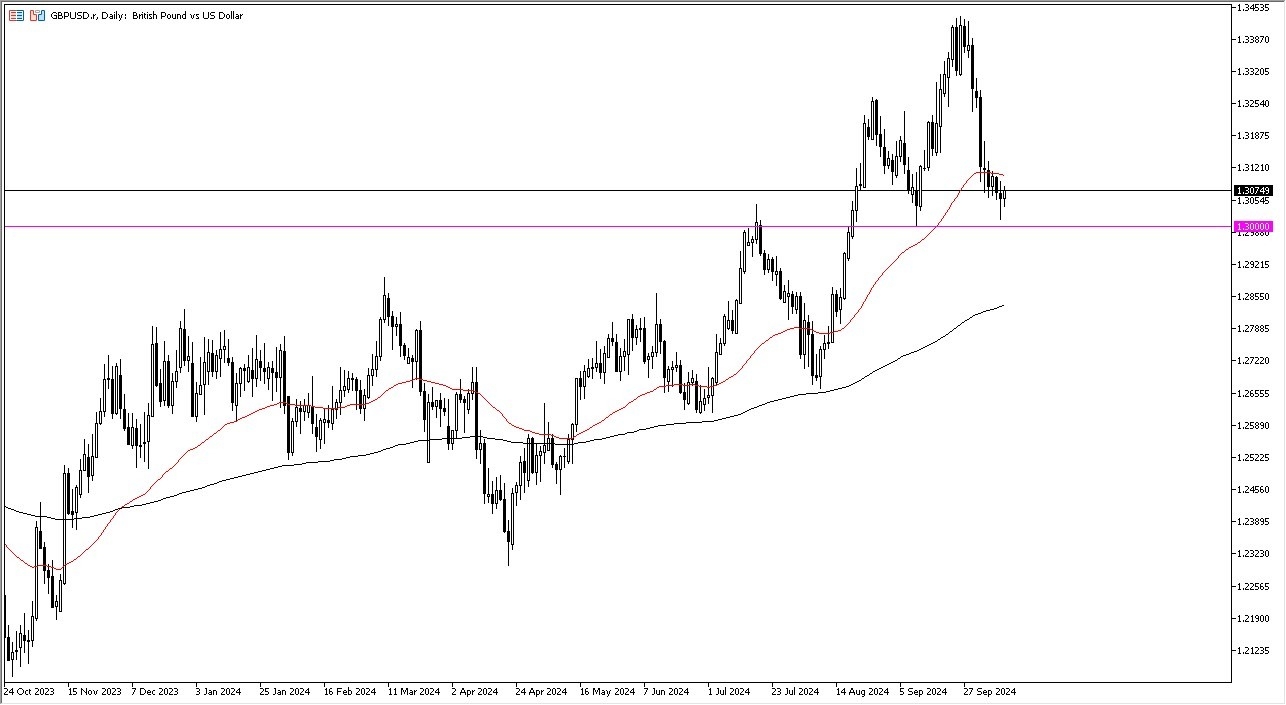

- I’d be a buyer of this pair on a daily close above the 50 Day EMA.

- At that point, I would put my stop loss at the 1.2990 level, and would be aiming for a move to the 1.3320 level.

- During my analysis of the GBP/USD exchange pair, the first thing I notice is that the 1.30 level continues to be very important.

- This is a large, round, psychologically significant figure that a lot of people will be watching as it has been important multiple times.

- In fact, it is an area where you would expect to see “market memory”, as it has been supported and has also been resistance multiple times in the past. All things being equal, this is a market that I think continues to see a lot of volatility, but it does look like it is setting up for a potential rally.

Just above, we have the 50 Day EMA, which of course is an indicator that a lot of people pay close attention to. If we can break above that on a daily close, I think at that point you probably have a real shot at the British pound rallied significantly and trying to get back to the highs. Recently, we have seen a certain amount of US dollar strength, mainly based on the idea that the Federal Reserve cannot cut interest rates like people once thought they were going to.

Top Forex Brokers

Federal Reserve

Ultimately, the Federal Reserve will probably be one of the biggest drivers aboard go next, as traders are trying to sort out what interest rates will be in the United States. The Bank of England has an economy that is now exiting a slow period, and now will have to deal with growth. With this being said, the market is likely to continue to see a lot of noisy behavior, but it is worth noting that while the Federal Reserve has recently cut 50 basis points, traders are now trying to determine whether or not the next rate cut will be 25 basis points, or if it will be nothing at all. Some of the data as of late have been a bit stronger than anticipated, so this does have traders thinking that perhaps the Fed might be a little bit more hawkish than anticipated.

Ready to trade our free trading signals? We’ve made a list of the best UK forex brokers worth using.