Potential Signal:

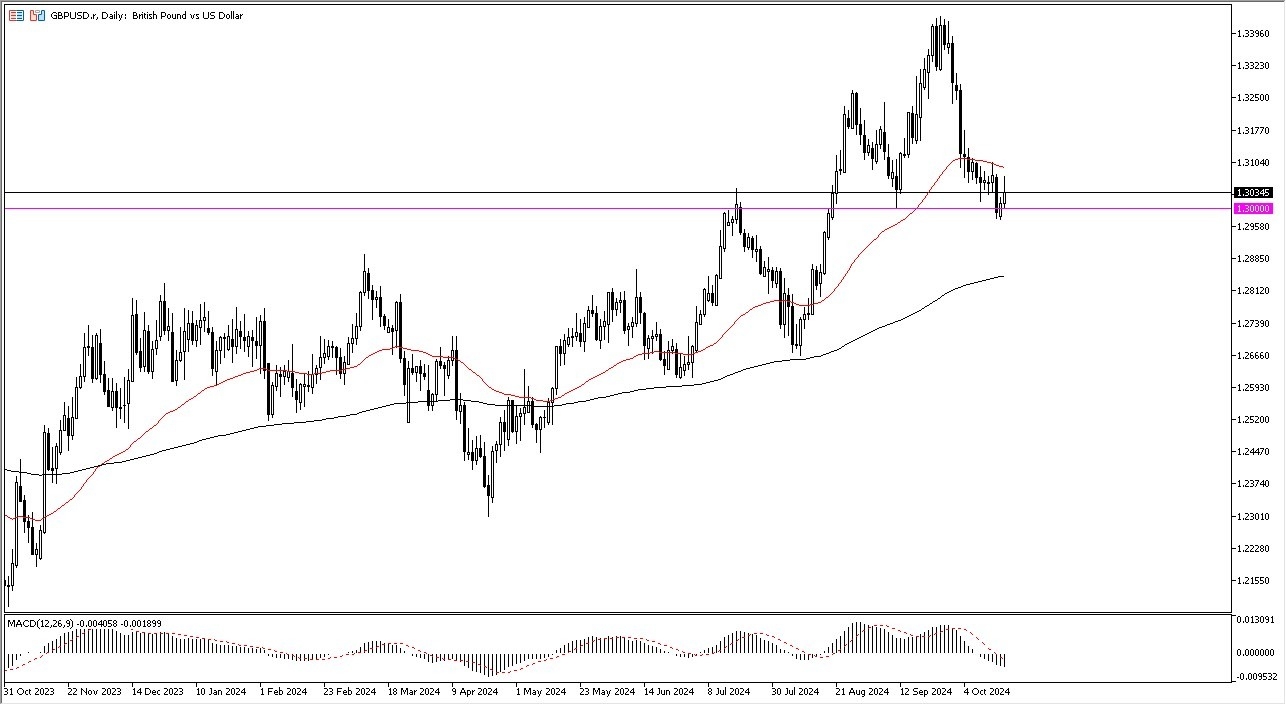

I’m a buyer of the GBP/USD pair at the 1.3120 level, with a stop loss at the 1.30 level. At the same time, I would go looking for a move to the 1.3333 level for a profit target.

- As I look at the GBP/USD pair, the market continues to look very interesting to me, as we have bounced from the crucial 1.30 level.

- It is worth noting that the 1.30 level is a large, round, psychologically significant figure, and an area that a lot of people will be paying close attention to This is an area that has a lot of “market memory” built into it.

- as we have pulled back to that region and then bounced previously, as well as have seen a lot of resistance in the past.

Top Forex Brokers

Technical Analysis

The technical analysis for this market is rather bullish, despite the fact that we have seen a lot of selling pressure in the past. After all, the market had spiked all the way to the 1.34 level before plummeting.

[graph_5756]but at this point in time, we also have to keep in mind that the market will continue to see a lot of volatility, but I think it’s also worth noting that we will notice the Bank of England and its somewhat hawkish behavior, at least in comparison to so many others, as a major reason to think that this market could rally a bit from here.

If we can break above the 50 Day EMA, the market is likely to continue to go looking toward the 1.34 level.

By breaking above the 50 Day EMA, then the market is likely to be fairly bullish, and it could open up a significant run higher. On the other hand, if we were to break down below the 1.2950 level, then we could see the British pound dropped to the 200 Day EMA, which is near the 1.2850 level.

I don’t necessarily think that’s as likely to happen, but it is something to keep in mind in case the US dollar suddenly takes off around the world. After all, the greenback does tend to move in tandem over the longer term.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers UK to check out.