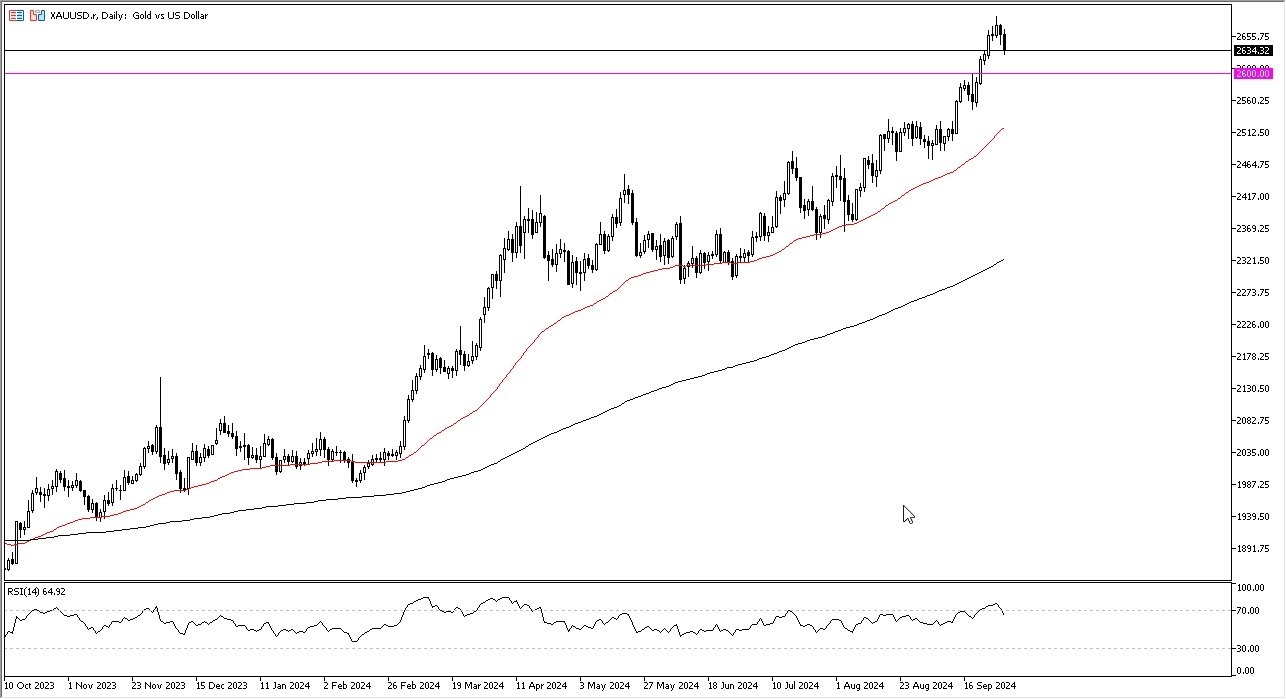

- Gold continues to pull back a bit in the early hours on Monday, continuing a move that we had seen on Friday.

- That's not a huge surprise as gold has shot straight up in the air for some time.

- Eventually somebody comes to collect profit. I'm watching very closely this market right now though, because I do think it will offer some value.

Underneath the current trading levels, we have the $2,600 level, which is likely to be a major support level based on psychology and the fact that it is a large round psychologically significant figure because of this. I think it is also possible that, uh, market participants will also pay close attention to the idea of geopolitics getting worse, not better, and of course, the idea of the US dollar shrinking due to the Federal Reserve cutting rates. We are in an environment where gold continues to see plenty of reasons to go higher, not the least of which would be interest rates and geopolitics, but also there are massive central banks out there buying gold hand over fist at the moment. Some of the ones that we know about include India, China, and Russia.

Top Forex Brokers

Those three alone will cause a certain amount of demand. And furthermore, with the Federal Reserve likely to continue cutting rates, that makes bonds much less attractive than they normally would be in a high interest rate environment. I do think this pullback is just a technical one, and I suspect it is probably only a matter of time before buyers get involved, but a move to the $2,600 level would be very interesting for me.

Trading this Market

I don't want to chase gold. I've been saying this for several days and we are now starting to see the market give back some of those gains, but I do not for a second believe that this is some type of change of trend.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.