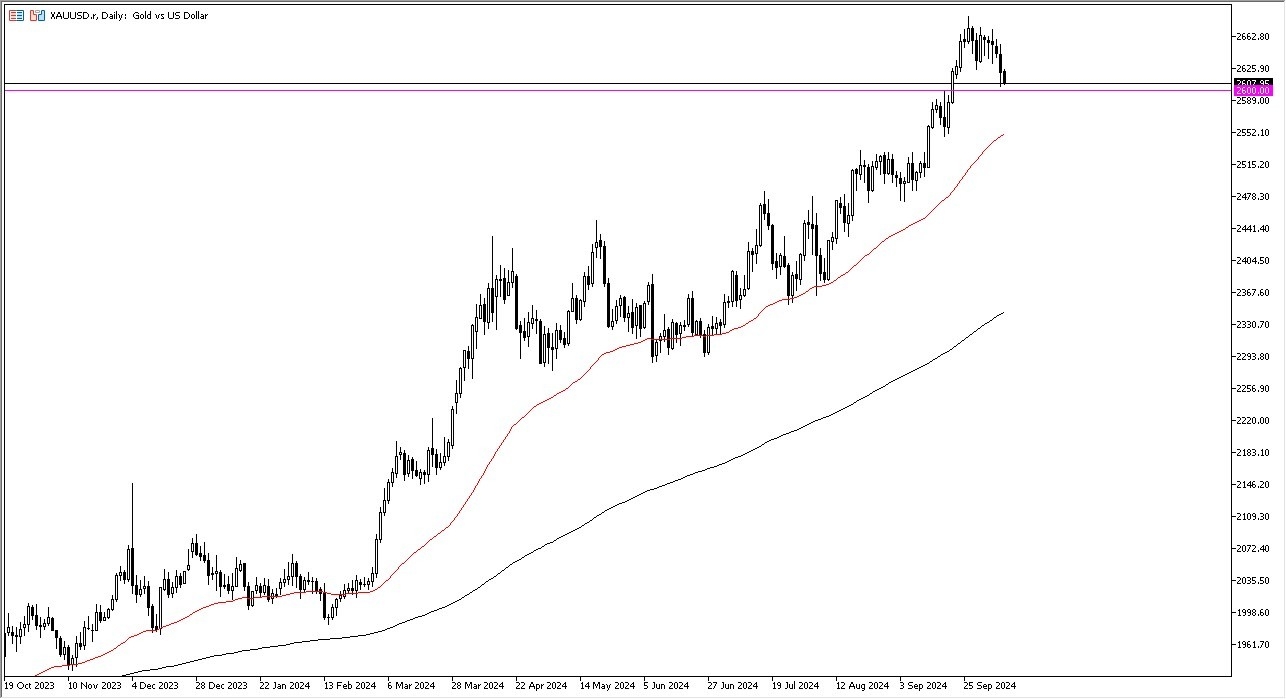

- During my daily analysis of the gold market, the first thing I see is that we continue to look at the $2600 level as a massive support level.

- All things being equal, this is a market that will pay close attention to that big figure as it had been previous resistance, so I think there’s a certain amount of “market memory” coming into the picture.

- Therefore I think it’s probably only a matter of time before the buyers returned, just as they did during the Tuesday session.

Even if they don’t, I think there are plenty of support of areas underneath, extending down to at least the 50 Day EMA near the $2550 level. That’s an area that previously had been supported, so I don’t see any reason why it won’t be again.

Massive Reasons for Bullish Pressure

Top Forex Brokers

I think there are a massive amount of reasons for bullish pressure in this market, not the least of which of course is going to be the fact that the reserve has cut interest rates by 50 basis points, and just last night, the Reserve Bank of New Zealand did the same, suggesting the central banks around the world are starting to get a little bit nervous. As they cut interest rates, it makes holding gold a little bit more palatable, because large firms will be able to pay the storage fees in the face of lower interest rates on bonds which of course is much easier to get involved with as they are digital.

Geopolitics have a lot to say as well, and quite frankly we just don’t have a good outlook for the world at the moment. Conflict is everywhere, and of course we have a lot of uncertainty when it comes to elections throughout the Western world.

Beyond that, we also have the overall trend that has been bullish for some time, and although we have seen a bit of a pullback, the reality is that we are still very much in an uptrend. Momentum tends to beget momentum, and I think that will be the case here as well. And finally, also keep in mind that central banks around the world continue to acquire gold, adding a little bit of a permanent “bid into the market.”

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.