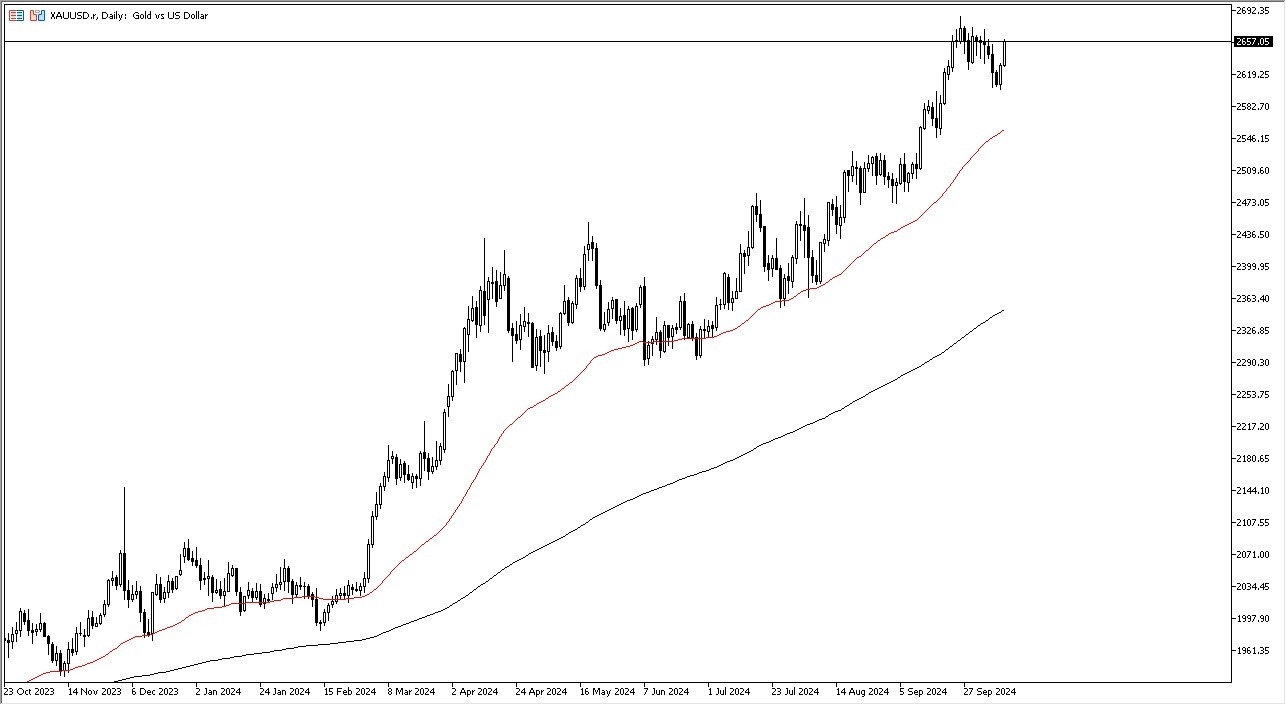

- Gold has rallied again during the trading session here on Friday, but we are getting fairly close to some significant resistance, and it's probably worth noting that we shot straight up in the air over the last two days.

- In other words, I think we might have a situation where we probably run into a little bit of exhaustion, and therefore I think a pullback makes a certain amount of sense, as markets cannot go straight up in the air forever.

With that being said, we have a scenario where traders continue to look at this through the prism of a market that has been very strong, will more likely than not continue to be very strong. But really at this point in time, I suspect that we might have a little bit of a give back. That give back should offer value and potential cheap gold ounces, which of course the market will probably swallow a hole. The $2,600 level continues to be an area worth watching, perhaps even the $2,625 region, which also has had some influence on short-term charts. To the upside, if we can break above the $2,685 level, it opens up $2,700 and beyond.

Top Forex Brokers

Gold Remains Strong Over Time

This is a very strong market and that has not changed. For what it is worth, the weekly candlestick that we're about to form will probably look a lot like a hammer, suggesting that every time we drop, there's plenty of buyers. The 50 day EMA is all the way down at the $2,550 region. So, we have a long way to go before we see anything worth worrying about.

You could also make an argument that we are in the midst of trying to break out of a bullish flag. Either way, all these things point to higher levels in the gold market, as we continue to see a lot of buying pressure due to a whole host of reasons.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.