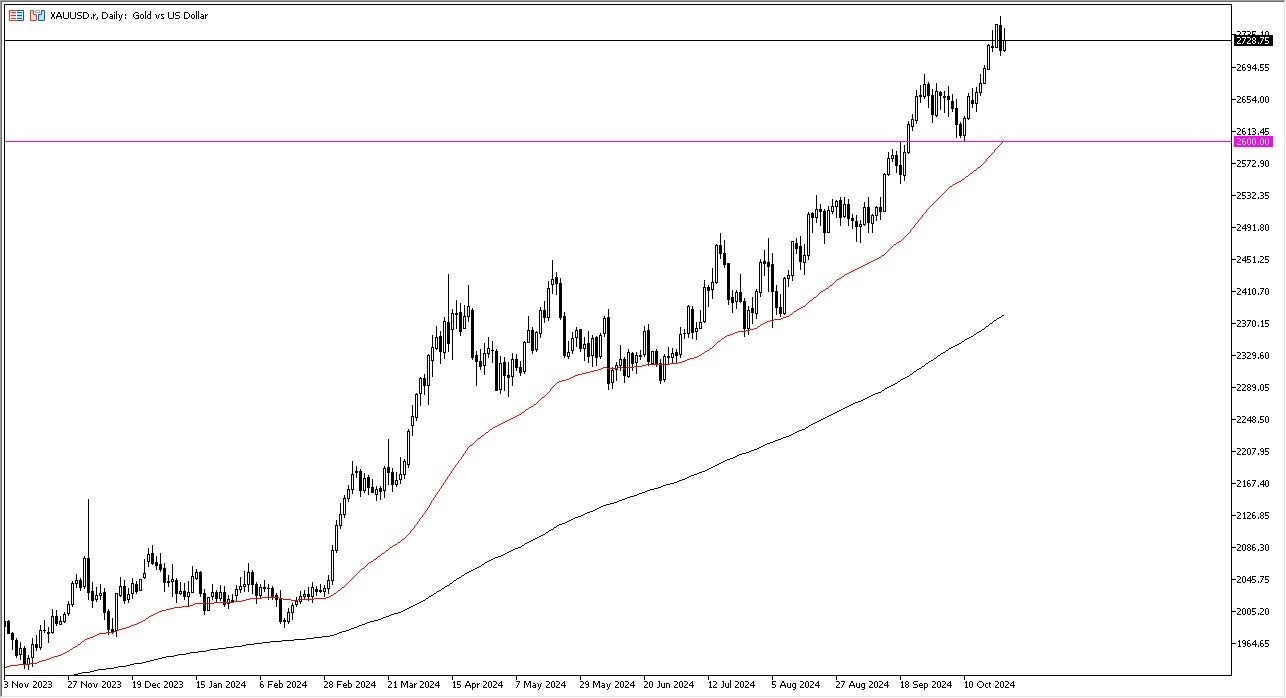

- The gold market continues to plow higher during the trading session on Thursday, but it's probably worth noting that we are giving back some of the early gains.

- This is a market that had gotten so far ahead of itself. It's not surprising that we are giving back a bit.

- Somewhere near the $2,700 level, I would anticipate a little bit of support, but I think the true floor in the market right now is the $2,600 level.

$2,600 also features a 50-day EMA, and that can attract a certain amount of technical trading as well. It doesn't take a whole lot of imagination to see the bullish flag that's on the chart, and that measures $2,800. All of that being said, the fundamentals for gold remain very positive, including the fact that central banks around the world are buying it. And then, of course, you have central banks around the world cutting interest rates.

Top Forex Brokers

Geopolitics and More

Beyond that, you have a lot of geopolitical tensions that come into the picture, and all of that combines quite nicely to make gold an attractive option. After all, gold is considered to be a safe haven. The markets right now are perhaps struggling a little bit with the way we had gotten a little overstretched, but more likely than not, any pullback at this point in time will look at a possible buying opportunity for market participants.

The trend is very strong. There's really nothing on this chart that tells me anything is going to change any time soon. So even if you told me we were going to pull back over the next 24 hours, I would not be a short seller. I would just simply buy it at a lower level. 3000, I believe is the target eventually, but it's not as if we're going to get there tomorrow.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with