- During the trading session on Wednesday, I noticed that in my analysis of commodities, the gold market is starting to get back some of the gains.

- All things being equal, this is a market that I think continues to see a lot of upward pressure, and I think that will continue to be the case, but quite frankly I think the Wednesday session is more or less about the idea of the market being overdone.

- I don’t have any interest in trying to short this market, and therefore I think you’ve got a situation where you will be looking for value in this market.

Top Forex Brokers

Technical Analysis

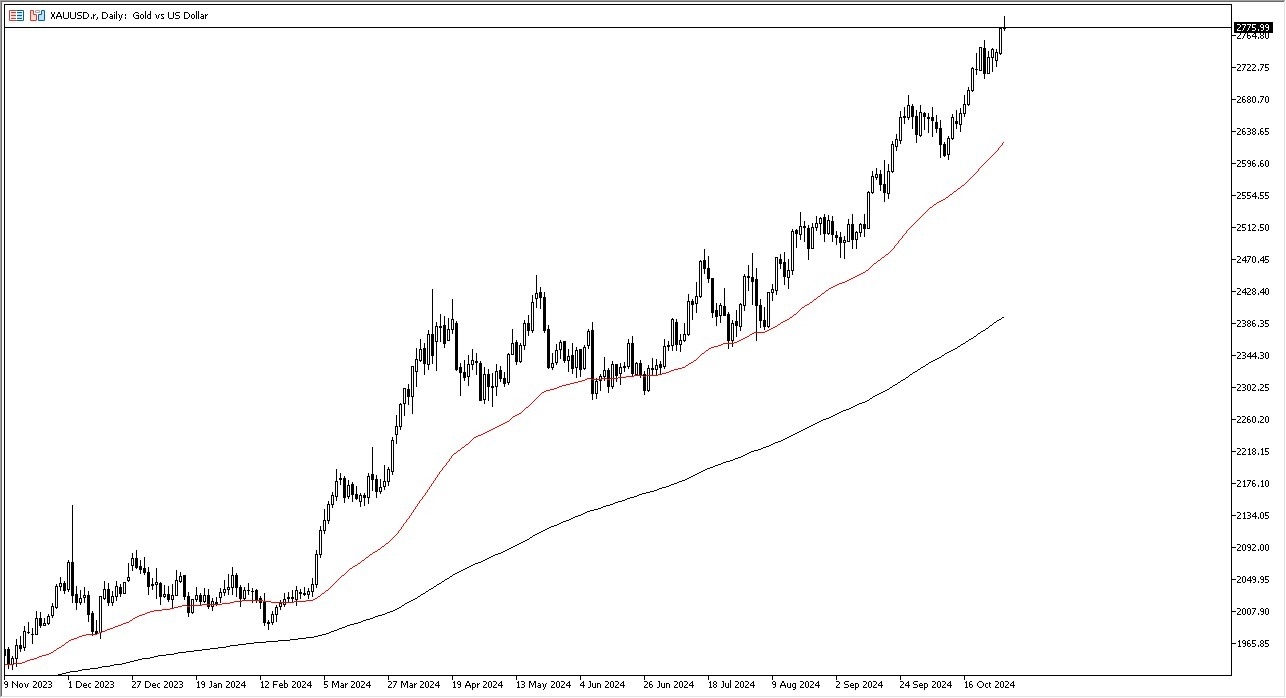

The technical analysis for this market is extraordinarily strong, and I think we will continue to see that be the case.

The Gold market has been bullish for multiple weeks, and at this point in time, the $2700 level should be a major floor in the market.I believe that the $2800 level above offers a certain amount of resistance, and therefore I think we’ve got a situation where that could make a short-term target, but if we were to break above there, it could bring in a lot of “FOMO trading.”

If we were to break down below the $2700 level, the market could go looking to the 50 Day EMA underneath, which is near the $2600 level and rising. This is a market that has been stretched for a while, and therefore I think you have got a situation where plenty of value hunting will continue over the longer term. Furthermore, we have a ton of fundamental reasons for gold to continue to go higher.

The first thing that I think about is that interest rates have been cut by central banks around the world, and of course there are plenty of geopolitical issues that people will be looking at. China, Russia, Indonesia, and India are all known buyers of gold, and therefore the central banks providing a bit of a floor in this market gives you an idea that we still have plenty of reasons to get long every opportunity that we have.

Ready to trade our Forex daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.