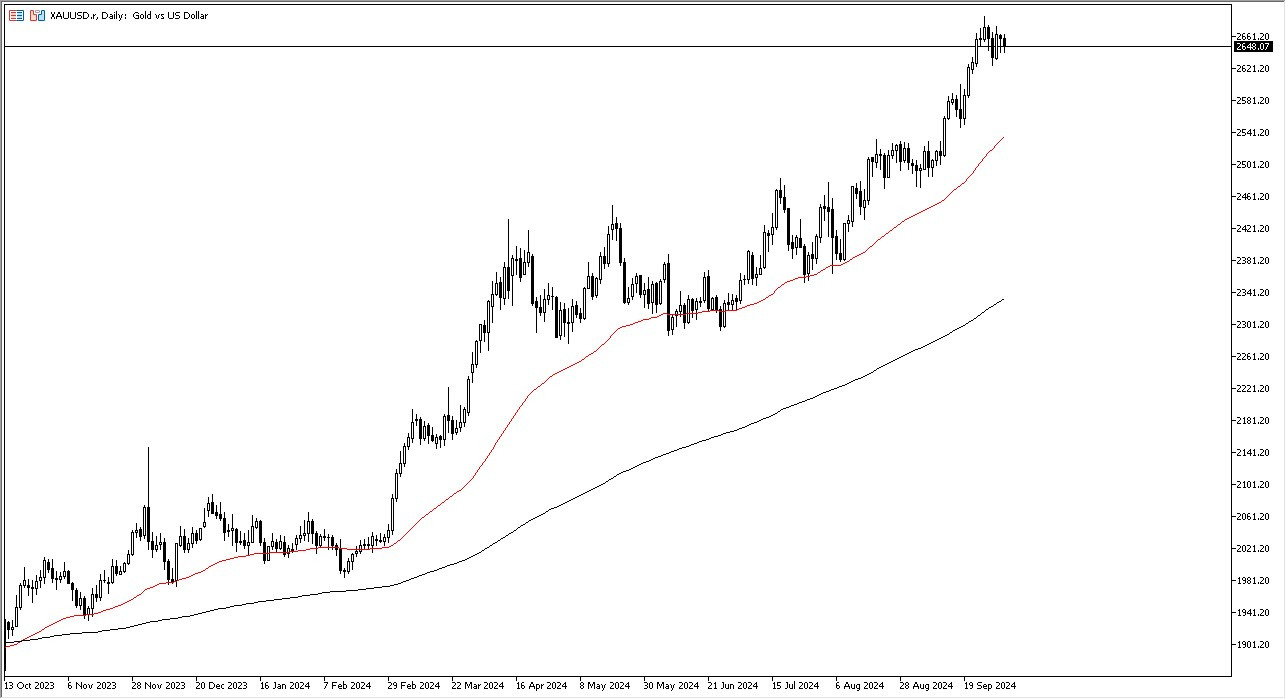

- Gold fell a bit during the early hours on Thursday as we continue to see a lot of volatility and chop overall.

- That being said, keep in mind that gold has been in an uptrend for quite some time, I would suggest that we have multiple support levels underneath that we need to pay close attention to and the biggest one I think at the moment is $2,530.

- It is not only an area where we had seen previous resistance, but we also have the 50 day EMA approaching that level as well.

Between here and there, we have the $2,600 level, which has shown a little bit of resistive power in the past. So, I would anticipate there's probably going to be a bit of market memory in this neighborhood.

On a Pullback

If we do in fact see this market pull back to that area, I anticipate that there will be plenty of value hunters willing to get involved. After all, we've got a situation where interest rates are falling around the world. Central banks like India, China and Russia are buying gold. And of course, the geopolitics of the world is a complete mess right now. Beyond all of that, it's just quite frankly, a strong uptrend and there's no reason to fight it.

Top Forex Brokers

We are in the midst of perhaps forming a little bit of a bullish flag at the moment, but only time will tell. Either way, I don't have any interest in trying to get short of this market. It's far too strong. And I do think that eventually we will go looking to the $3,000 level over the next several months. I suspect that at this point, anytime we drop, there will be plenty of people willing to pick up cheap ounces of gold. This of course is a market that will continue to attract a lot of attention, and rightfully so.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.