Potential Signal:

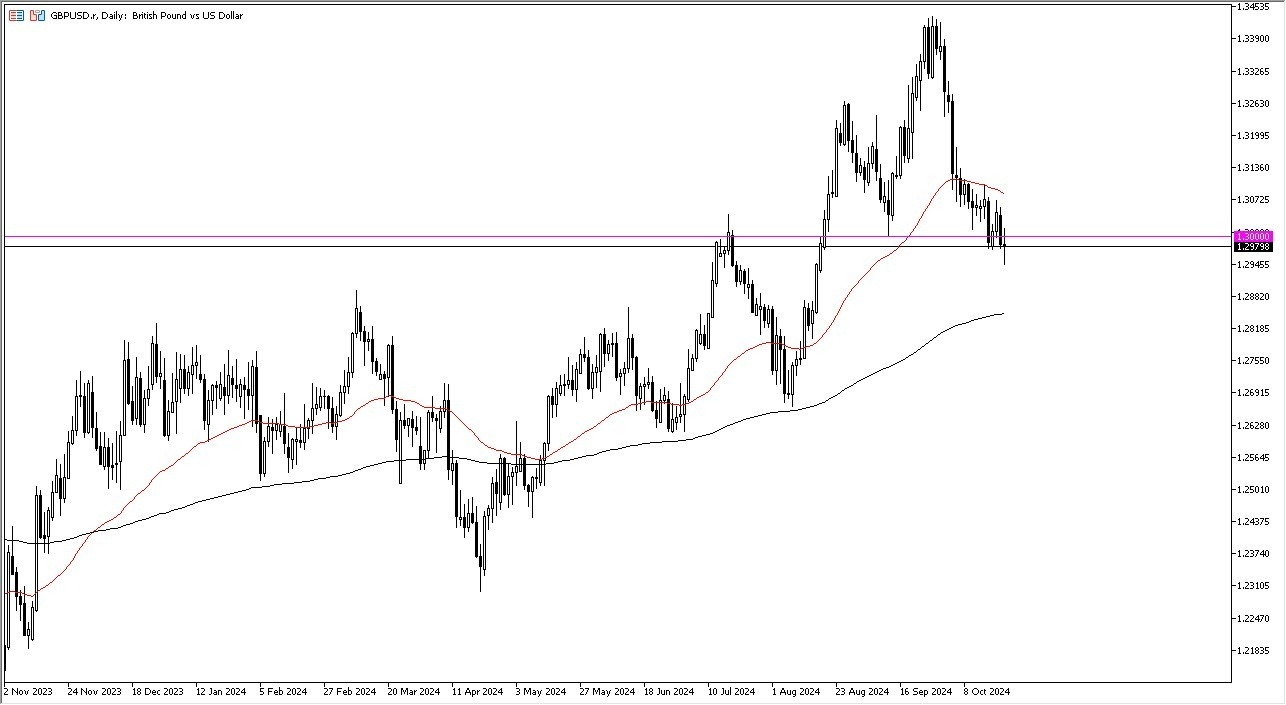

I believe this point in time, if we can break above the 50 Day EMA, I’d be a buyer of this pair. I would have a stop loss at the 1.2975 level, aiming for a move to the 1.33 level.

- During my daily analysis of the GBP/USD pair, the first thing I understood by looking at the chart is just how hesitant we are to make a bigger move.

- That being said, we also get PMI numbers later this week on Thursday, which could have a major influence on both of these currencies as both the United States and the United Kingdom or release those announcements at different points in the day.

- Because of this, think you have got a situation where we might see a bit of volatility between now and then, but ultimately, we will make a bigger decision.

Top Forex Brokers

On the Upside and the Down

If we can break above the 50 Day EMA, presently trading right around the 1.31 level, then it’s likely that we would see quite a bit of upward momentum in the British pound. Keep in mind that the US dollar is considered to be a bit of a “safety currency”, so therefore you need to be cautious about the overall risk appetite. After all, if we start to see risk appetite get eviscerated, that will help the US dollar strengthen, and that should, at least in theory, drive this pair lower. At that point, I think you have to look at the 200 Day EMA for potential support near the 1.2850 level. Anything below there could be catastrophic for the British pound, but I think it probably would be more or less a result of the US dollar strengthening against almost everything, not necessarily Sterling.

I do believe that we have a lot of noise ahead of us, and I do think that this is a market that will continue to be difficult to get your hands on, so like many of the other major currency pairs, I think that we are essentially in a bit of a “holding pattern.” This is because we are waiting for some type of fundamental analysis and news to get the markets moving. As things stand right now, I think we are simply treading water.

Ready to trade our daily GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.