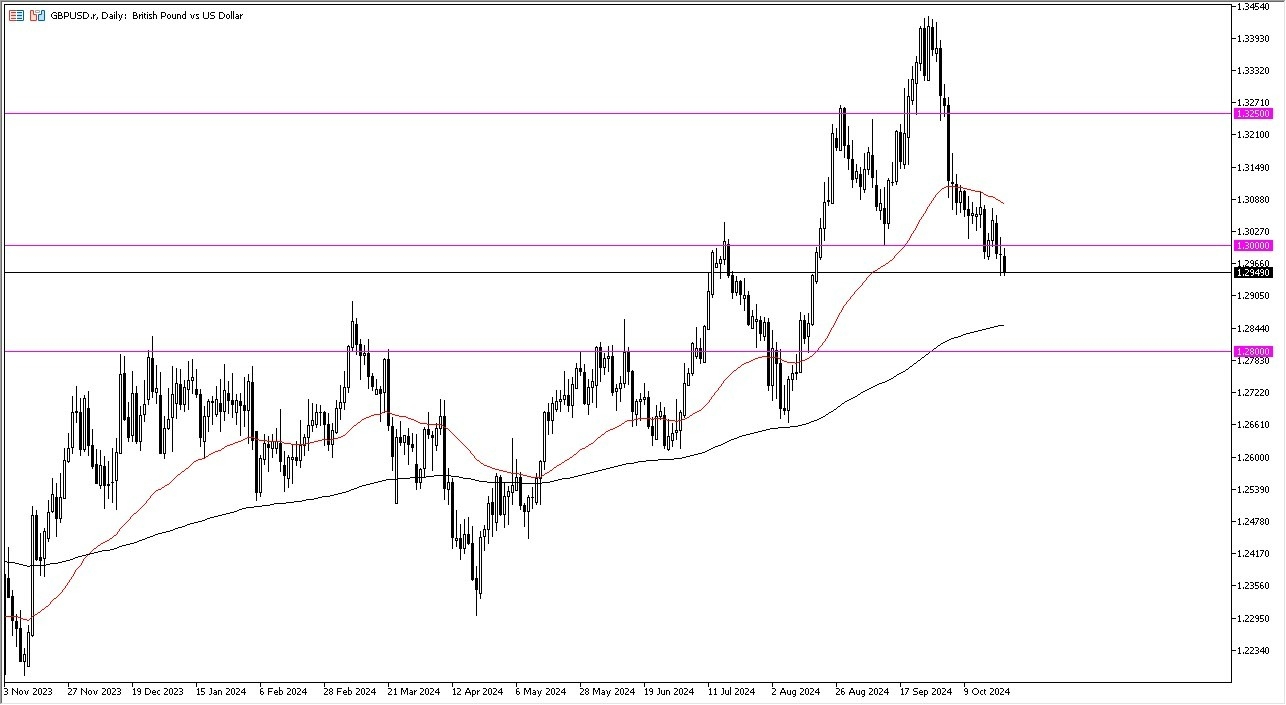

- The British pound continues to fall against the US dollar.

- And as you can see, it looks as if we are trying to break down rather significantly.

- If we do continue to fall, it's very likely that we will look to the 200 day EMA as a potential support level followed by the 1.28 level.

Now keep in mind that the Thursday session features PMI numbers coming out of multiple countries, including both of these, we will initially get the United Kingdom manufacturing and services PMI figures. But later in the day, we will also get the same coming out of the United States. If we turn around and rally from here, especially at the end of the day on Thursday, and break above the 1.30 level, it could be the beginning of a recovery.

Top Forex Brokers

Headwinds Above

The real test will be the 50 day EMA above that could cause a significant amount of resistance. If we break down from here, again, I think we go looking to the 200 day EMA and then eventually the 1.28 level. The market has seen rather massive selling. But when you look at the structure of the price action in the British pound, it looks very similar to a lot of other currency pairs, such as the Euro against the dollar, the Australian dollar against the US dollar, the New Zealand dollar against the US dollar, and so on. So this is clearly all about the US dollar and the fact that interest rates in America continue to rise. If that remains the same, the US dollar could very well swallow everything.

This has been the case for multiple times over the course of the year, and for the same reason, the fact that interest rates are rising in the United States. Now that the bond market is essentially telling the Federal Reserve that they are wrong, things could get rather ugly but also, we need to keep in mind that those PMI figures could cause a lot of noise.

Ready to trade our daily GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.