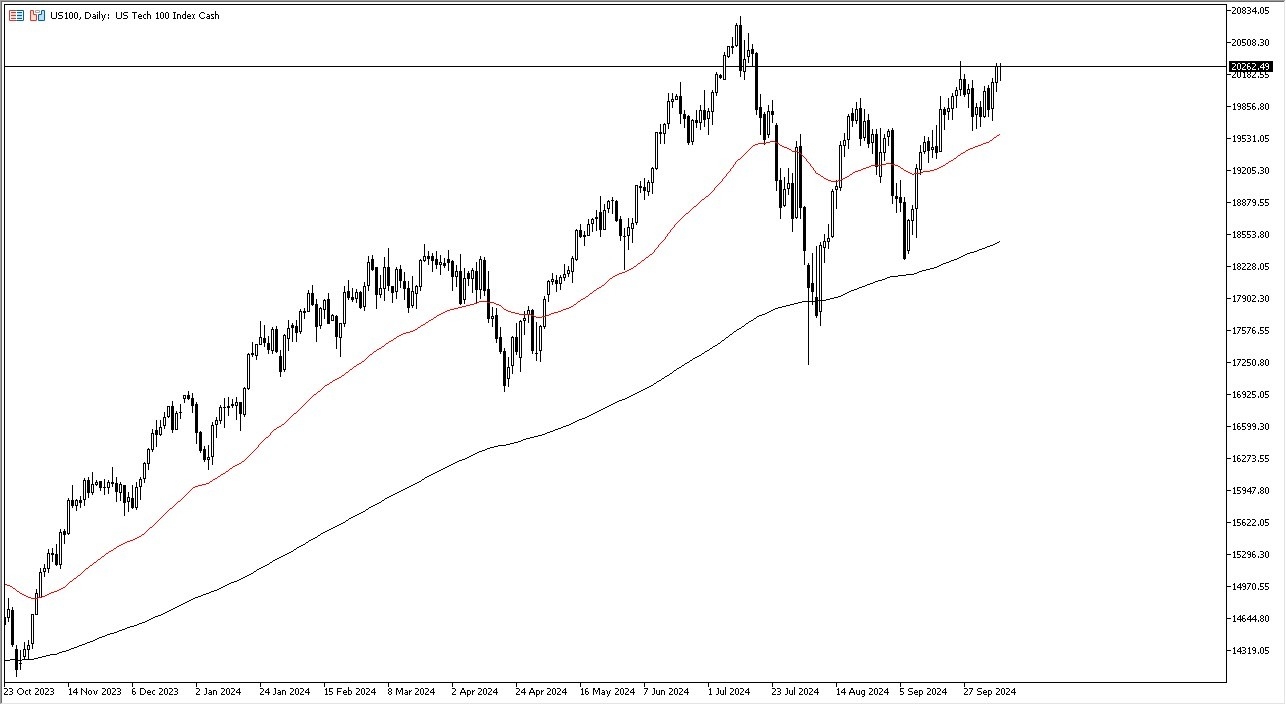

- The NASDAQ 100 initially fell during the trading session on Thursday, but it now looks as if it is trying to take off to the upside.

- The 20,300 area seems to be a little bit of a barrier, and at this point, I do think that we are trying to do everything we can to find reasons to go higher.

- A loose monetary policy situation in the United States certainly has been one of the big pushes higher for the NASDAQ.

Whether or not it can continue to go higher like this, we'll have to wait and see, but certainly there's nothing on the chart that suggests you should be shorting this market anytime soon. After all, we get PPI numbers on Friday and the pattern has been CPI a little hotter than anticipated, PPI a non-event.

Top Forex Brokers

The Reaction to CPI Tells Us a Lot

So now that we have reacted to a hotter than anticipated CPI number earlier in the day by turning around and buying the NASDAQ, that tells me that more likely than not there will be plenty of buyers willing to get involved on the dip, assuming that we even get one. I do think that it is probably only a matter of time and it's probably not much time between now and the attempt to break out to a fresh new high.

Stock markets look very bullish. I don't think the NASDAQ 100 is going to divert from that. If we do pull back somewhere near the 19,700 level, I'd expect to see a certain amount of support, especially as we have market memory from the last couple of weeks, and we also have the 50-day EMA, both of which would attract a certain amount of value hunting anyway. So, with all of this, I remain bullish. I recognize it's a bit of a slog and a fight, but certainly it looks like the buyers are more in control than the sellers are at this point.

Ready to trade the daily stock market forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.