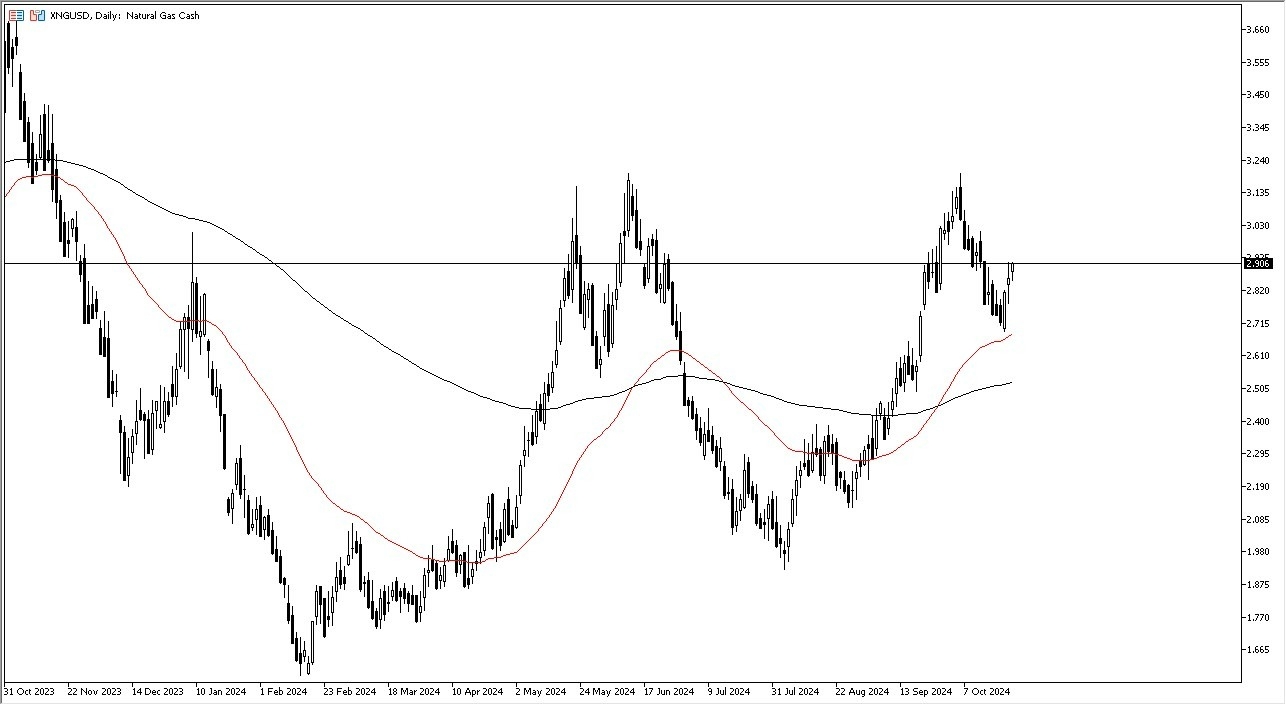

- In my daily analysis of the natural gas market and the commodity markets on the whole, the first thing I see is that it looks like we are at least trying to turn things around.

- The natural gas market has gapped higher to kick off the trading session on Wednesday, and I think at this point in time it makes a certain amount of sense that we will go looking to the $3.00 level above.

- The market has been very noisy, and therefore I think it’s not a huge surprise to see that we are chopping around. However, I would draw your attention to the Monday candlestick, which was a massive bullish engulfing candlestick.

Furthermore, that massive bullish engulfing candlestick bounce from the 50 Day EMA, which is also near the $2.70 level. Now that we have bounce significantly from there, it makes a certain amount of sense that we could go looking to the $3.20 level above. All things being equal, this is a market that I think short-term pullbacks will continue to attract a certain amount of attention going forward.

Top Forex Brokers

Technical Analysis and Seasonality

Keep in mind that the technical analysis remains very bullish, especially as the market has bounce from the crucial 50 Day EMA, something that a lot of people will pay close attention to. If we can break to the upside, the $3.00 level would come into the picture and therefore I think if we can break above there, we could see a rush of “FOMO trading” jumping into this market.

On pullbacks, I think that 50 Day EMA comes into the picture to offer support, just as the 200 Day EMA does. The 200 Day EMA is near the $2.50 level, and therefore I think there’s a certain amount of psychological importance in that general vicinity that we need to be paying close attention to.

Furthermore, you have to keep in mind that the futures markets are doing what they can to price in the idea of the winter in the northeastern United States driving up the demand, and of course the price of natural gas as supply will dwindle in that scenario, like it does every year.

Ready to trade daily Forex forecast? Here’s a list of some of the best commodities brokers to check out.