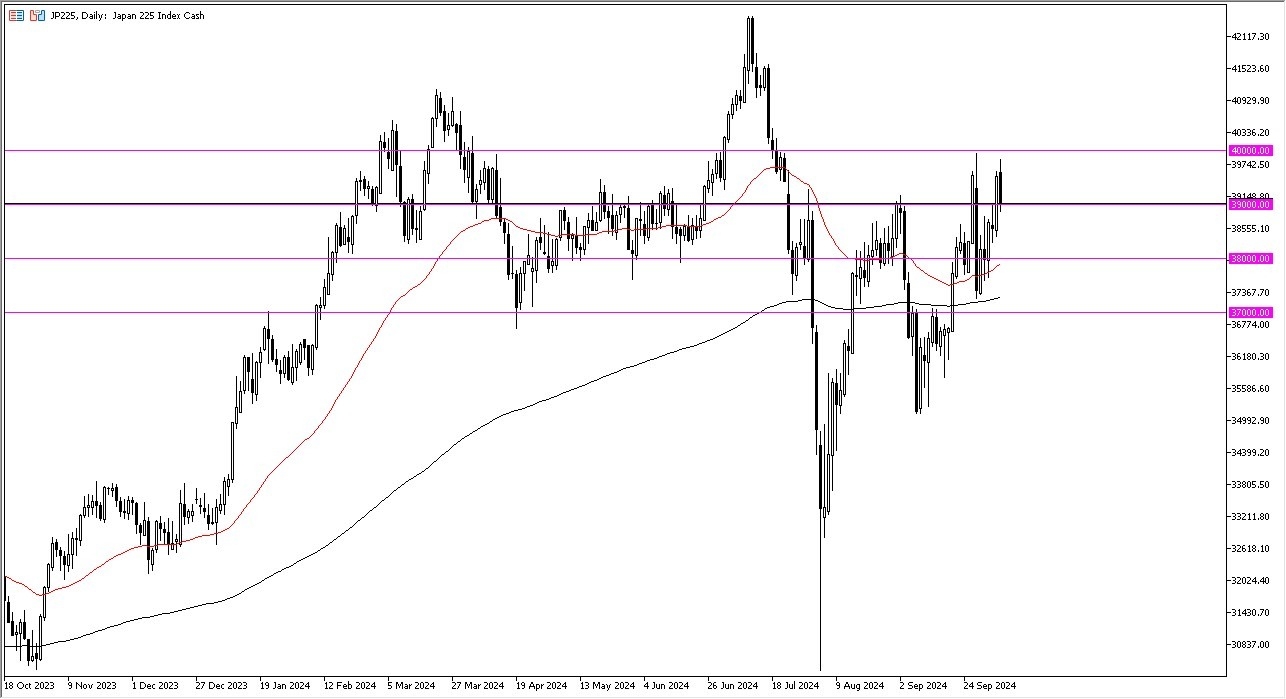

- As you can see, the Japanese index has pulled back pretty significantly during the trading session on Monday, but that does make a certain amount of sense, considering that the 40,000 level has a lot of psychology attached to it.

- It's an area that we have recently seen a lot of resistance at previously, as “market memory” could come back into the fray.

As I record this video, we are hanging around the 39,000 yen level. This is an area that's been important as well. If you look at the chart from a longer term daily timeframe, you'll notice that there does seem to be a bit of a move every 1000 yen. So, this all lines up as more of the same. This pullback, I think we'll end up offering a buying opportunity eventually, especially if the Japanese yen loses some strength.

Top Forex Brokers

I fully anticipate that to be the case eventually. But it's worth noting that the Japanese Yen had been sold off rather significantly over the last, say, 10-ish days or so. So, this is just a simple pullback in what I think will continue to be an uptrend. After all, the Nikkei is a heavily export-laden index that a lot of people will be watching the Japanese Yen for directionality.

Noisy Market Ahead

In general, I think the market will continue to be noisy, but I do think that it will continue to be positive over the long term. I have no interest in shorting the Nikkei, just like I have no interest in shorting any of the other equity indexes around the world, because it looks like we're getting more of that liquidity injection from central banks. If that's going to be the case, stock prices typically go up in this environment, but we will have to wait and see how this particular market behaves, because it is so highly sensitive to the Bank of Japan and pooping monetary policy loose.

Ready to trade the daily stock market forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.