Potential signal:

- I am a buyer of the Nikkei 225 at the ¥40,000 level.

- If we were to break above there, I would aim for the ¥42,000 level, with a stop loss at the ¥39,500 level.

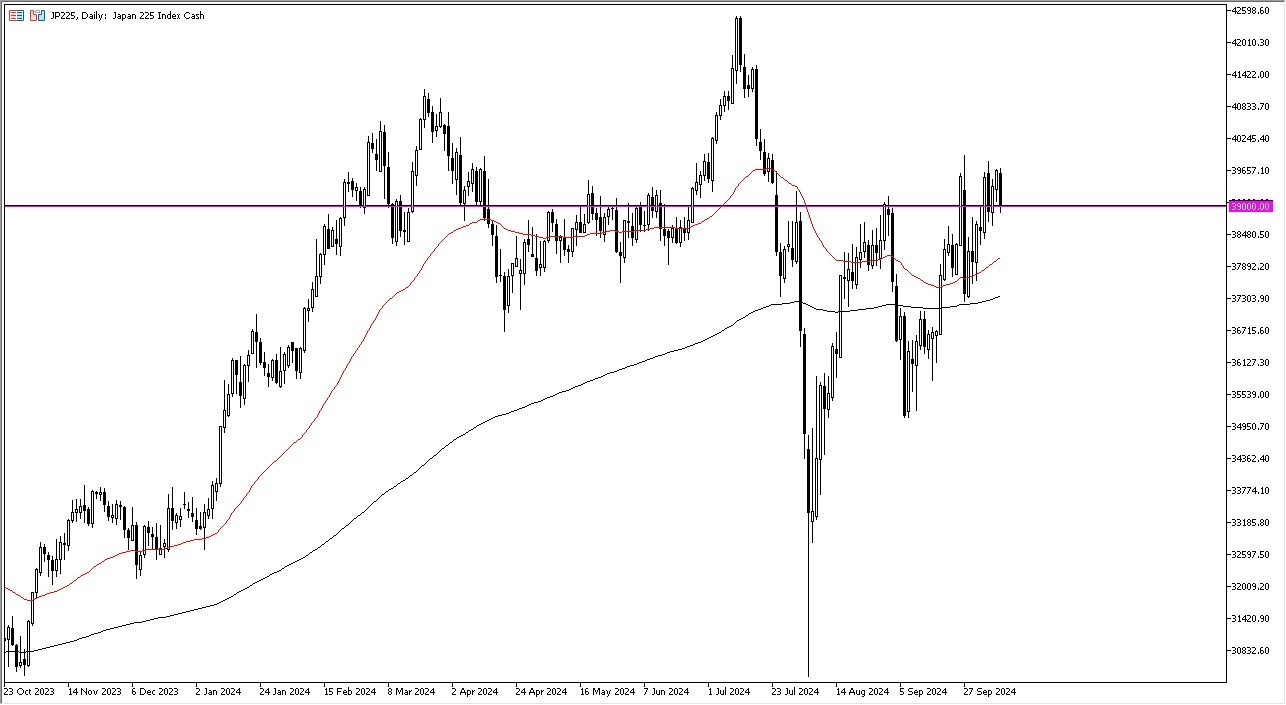

The Nikkei 225 fell a bit during the trading session on Thursday, as we continue to watch this index very carefully. After all, the Nikkei 225 is the largest index in Asia, and therefore it is a good barometer on what’s going on economically in that part of the world. The ¥39,000 level has been important multiple times, so I do think it makes quite a bit of sense that we have seen a little bit of a pushback against the selling pressure during the day.

Top Forex Brokers

That being said, I am paying close attention to the ¥39,750 level, as it has offered significant resistance over the last couple of weeks. If we can break above that level, then I think it’s likely that the market will continue to go higher, perhaps reaching toward the ¥40,000 level, which of course is a large, round, psychologically significant level. If we can break above that level, then it’s likely that we could go much higher, perhaps reaching toward the ¥42,000 level.

On the downside

If we were to break down from here, then the 50 Day EMA is worth paying close attention to, near the ¥38,000 level. Anything underneath there opens up the possibility of a move down to the ¥37,300 level where the 200 Day EMA currently resides. That of course is a technical indicator that a lot of people would be paying close attention to, so with that being said, the market is likely to continue to be volatile, and I do think that there will be plenty of buyers willing to step in.

I recognize that this is a market that is also heavily influenced by the Japanese yen, and if the Japanese yen starts to pick up strength, that’s actually bad for the Nikkei 225, because it is full of exporters, which of course need Japanese goods to be somewhat affordable for foreign buyers around the world. Because of this, I think you need to also pay close attention to the USD/JPY pair, when you look to trade the Nikkei 225.

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.