- The New Zealand dollar has plunged during trading on Wednesday, which is not really a huge surprise considering that the Reserve Bank of New Zealand has cut interest rates by a whopping 50 basis points.

- This brings up a lot of questions, not only about New Zealand, but perhaps about the global economy on the whole. This market will continue to watch these central banks going forward.

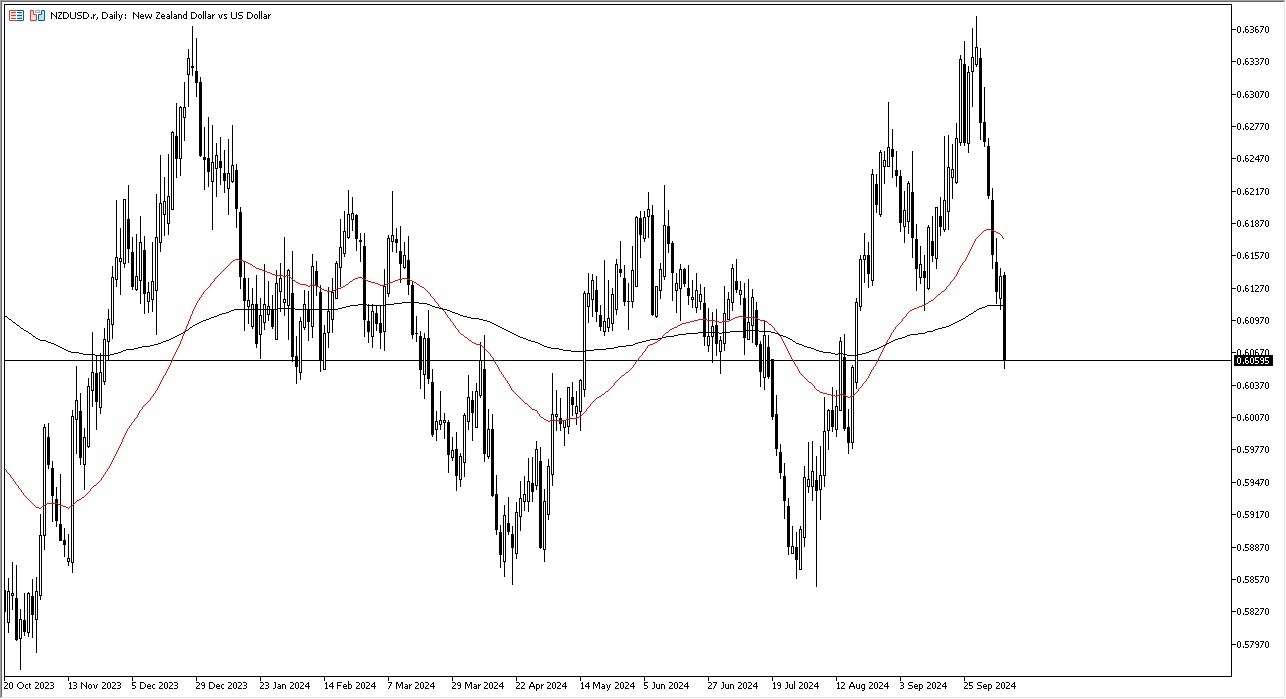

Generally speaking, central banks don't cut this rapidly in a great environment. And that does certainly apply to the Federal Reserve as history has shown us, but it also applies to places like New Zealand. Remember, New Zealand is a commodity currency and is a major exporter of soft commodities to various parts of the world, but particularly Asia. So, if the Kiwis decide that there's something going on that they need to loosen monetary policy for. That's not a good look for Asia as well. And if Asia falls, one would have to think that's a bad sign for everybody. All things being equal, this is a massively oversold condition but moves like this certainly seem to continue to the downside. I think at this point, you have to look at rallies as potential selling opportunities, especially now that we're below the crucial 200-day EMA, which could very well act as a bit of a resistance barrier.

Top Forex Brokers

The Market Continues to Plummet

Quite frankly, the NZD/USD market has plummeted straight down from the 0.6350 level in a merciless 300-point drop, which tells you most of what you need to know. At this point, I'm looking to fade the New Zealand dollar rallies as they occur, and I do think eventually we could find ourselves down at the 0.59 level. Granted, the market sniffed this out ahead of time, but with this type of reaction, even after the announcement and the selling off for the previous week, that tells you the New Zealand dollar is in trouble.

Ready to trade our daily Forex forecast? Here’s some of the best New Zealand forex brokers to check out.