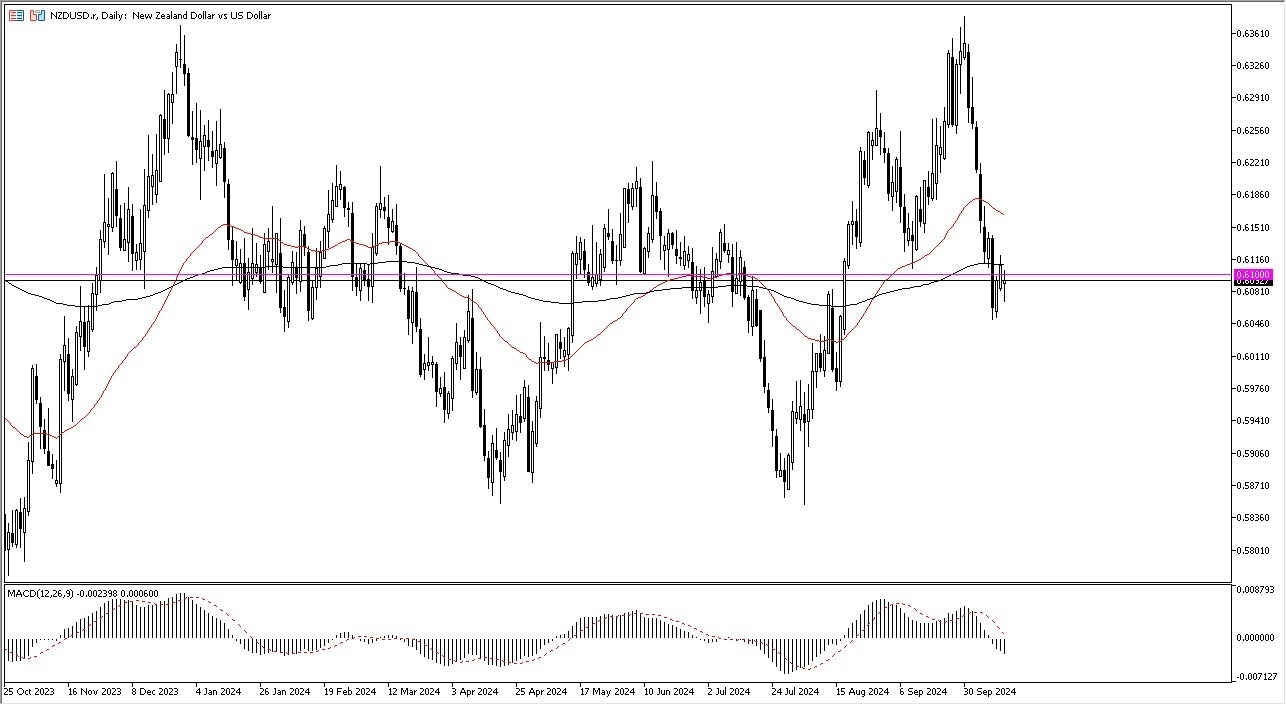

- In my daily analysis of the NZD/USD currency pair, the first thing I see is that we are going back and forth during the Monday session, as we are trying to figure out what we are going to do.

- All things being equal, the market is likely to continue to pay close attention to the 200 Day EMA above, which of course is an indicator that a lot of people pay close attention to.

- It is an indicator that a lot of people look to determine the longer-term trend, so I think the fact that we are sitting just below there, the market is likely to continue to see choppy in this region.

Reserve Bank of New Zealand

Recently, the Reserve Bank of New Zealand has cut interest rates by 50 basis points, and therefore it makes a certain amount of sense that the New Zealand dollar remains sought. In fact, the market sorted this out ahead of time, as we sold off quite drastically during the previous week.

Because of this, the market continues to see a lot of questions as to whether or not there is a path of viability for the Kiwi dollar going forward, as unlike the greenback, it doesn’t have the luxury of being a safety currency.

Top Forex Brokers

In other words, if things start to fall apart, it makes a certain amount of sense that we would see more of a rush into the greenback, especially as the US Treasury market of course demands US dollars.

If we were to break down below the 0.6050 level in the NZD/USD pair, then the market should drop rather significantly, as it could open up a move down to the 0.59 level. On the other hand, if we turn around and break above the 200 Day EMA, the 50 Day EMA is the next target, and breaking above that opens up a much bigger move, perhaps reaching all the way to the 0.6325 level. Keep in mind that if that happens, it’s more or less a major 'risk on move,' as the US dollar would likely be falling against most currencies, not just the New Zealand dollar.

Ready to trade our Forex daily analysis and predictions? Check out the most trusted forex brokers NZ worth using.