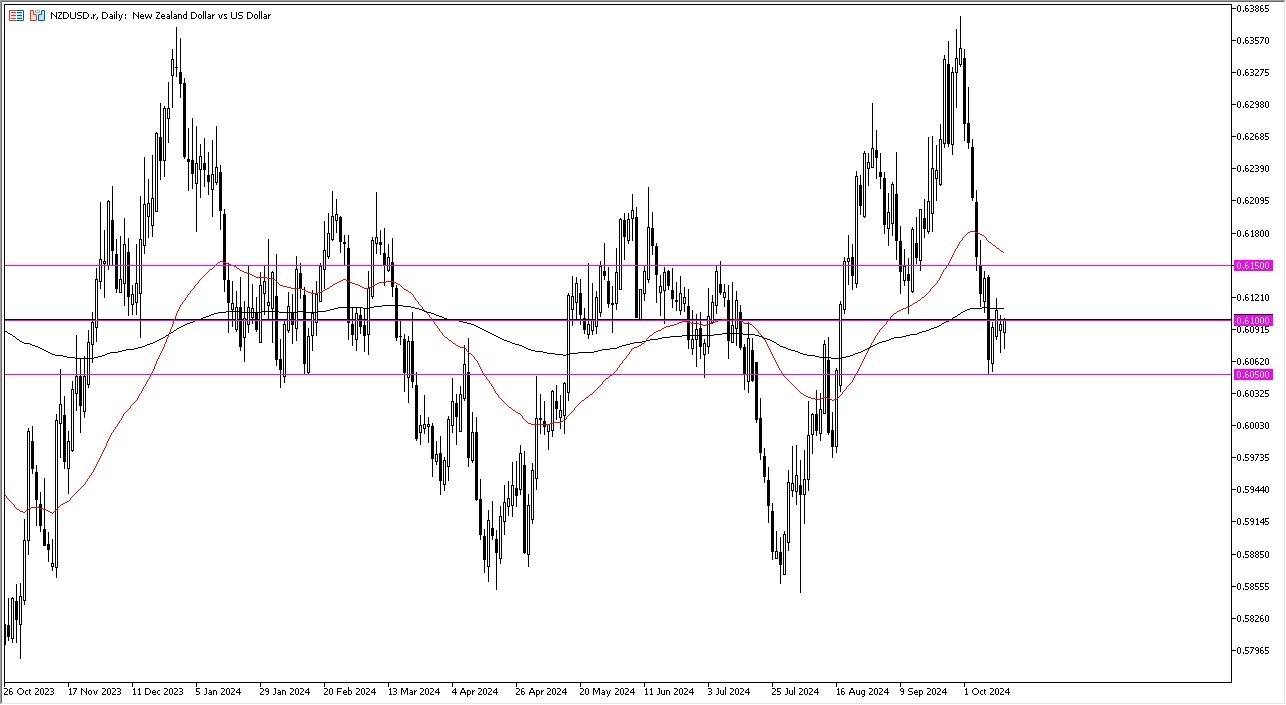

- Dear my daily analysis of the NZD/USD pair, the first thing that captures my attention is the fact that the market is hanging around the 200 Day EMA.

- This of course is an indicator that a lot of people paid close attention to in order to determine the overall trend of the market.

- The 200 Day EMA sits just above the 0.61 level, an area that we are currently attracted to it appears. In fact, when you look at the chart, you can see that we also have support at the 0.6050 level, and resistance above at the 0.6150 level, meaning that we are right in the middle of the latest technical range.

Top Forex Brokers

Commodity Influence

Keep in mind that the New Zealand dollar of course has a lot of influence on it by the commodity markets, specifically the soft commodity markets, as it is a major exporter of agricultural commodities to Asia, and therefore New Zealand is highly levered to Asian growth. While considered the “7th major currency”, the reality is that the New Zealand dollar does tend to be a bit more volatile than many others, so you need to keep that in mind when trading this pair. It’s not quite an exotic currency, but perhaps it is best thought of as a simple proxy for forex traders to take advantage of movements in the grain market, milk market, etc.

It also has a lot of sensitivity the global risk, so you need to keep that in mind as well. If risk sentiment starts to look really strong, then the idea is that the New Zealand dollar should continue to take off, especially against the US dollar, as the US dollar is considered to be the ultimate “safety currency” for forex traders, perhaps with the lone exception of the Japanese yen in Swiss franc, both of which have their own issues at the moment.

In fact, if this pair were to take off to the upside and break above the 200 Day EMA, I might be tempted to do a little bit of “triangulation”, meaning that I might look for trades in the NZD/CHF pair, or maybe even the NZD/JPY pair.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out