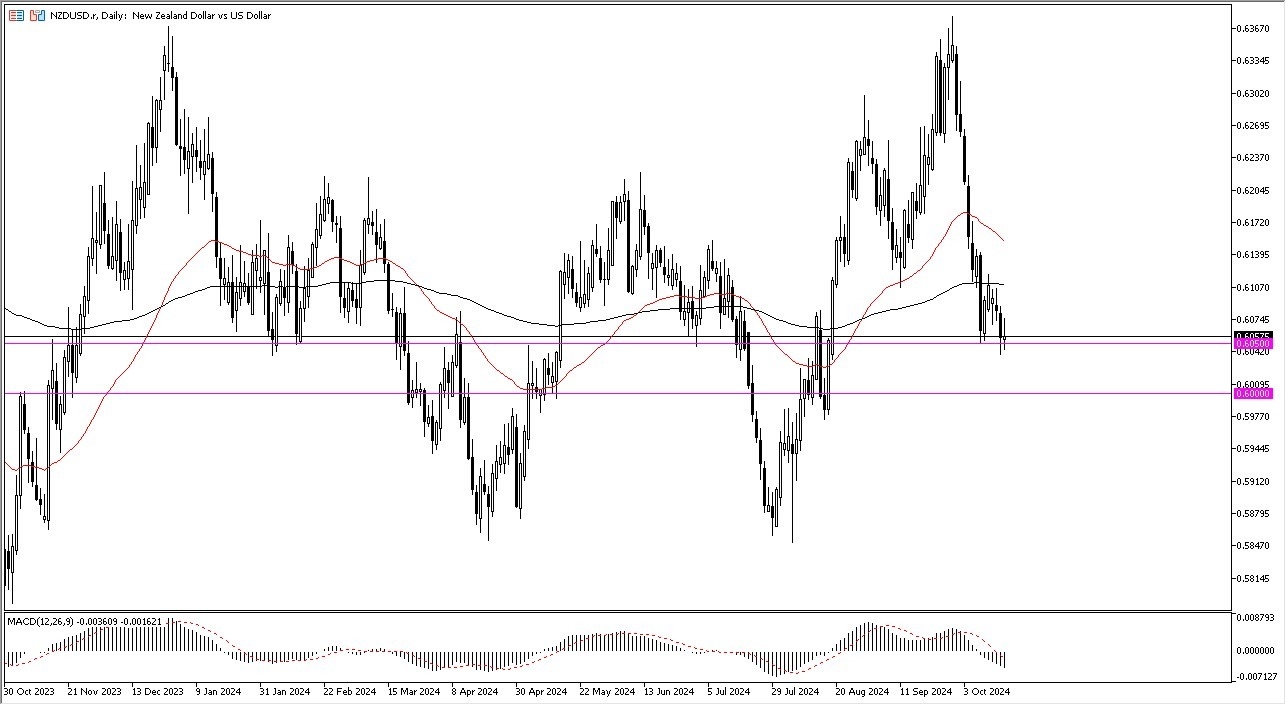

- Looking at the New Zealand dollar, you can see that the 0.6050 level continues to be crucial as it is offering support.

- There is a support range from the 0.6050 level down to the 0.60 level.

- This area has been important to say the least. At this point in time, the market continues to see a lot of choppy behavior, but that makes a lot of sense as the market will continue to try to determine where we are going to go next.

This is a range of support, and I do think that it is probably only a matter of time before we turn around and rally. If we can rally from here and break above the 0.6115 level and the 200 day EMA, I think at this point in time, we will see a situation where the market goes higher. All things being equal, this is a market that I think will continue to see a lot of volatility and choppiness.

Top Forex Brokers

Bottoming is Very Possible

But I do think that the New Zealand dollar is probably closer to bottoming than falling apart. However, if the Kiwi dollar does drop down below the 0.60 level, that would be extraordinarily negative, and that could send this market plummeting towards the 0.5875 level. On the upside, I do think that there is a lot of resistance after the recent selling pressure, so even if we do break out, I suspect it is probably short-term in nature.

After all, there are a lot of global issues when it comes to growth and trade. And of course, the New Zealand dollar is a commodity currency and therefore subject to the whims of risk appetite. With the Reserve Bank of New Zealand cutting interest rates by 50 basis points the other day, that has really, really slowed down what would have been a fairly strong advance by the Kiwi dollar and now we have pulled back about half of the moves from late July. At this point, I think we are probably going to grind back and forth and sideways more than anything else as the market catches its breath.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.