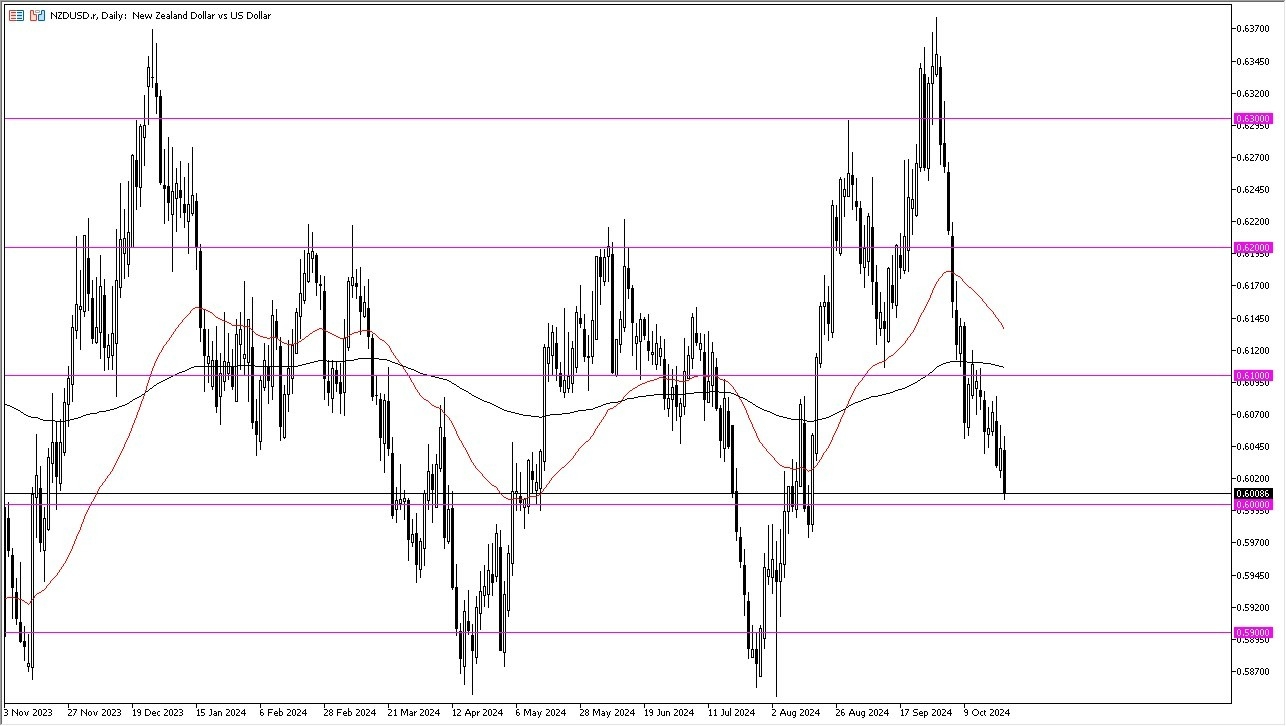

- My daily analysis of the NZD/USD pair on Wednesday, the first thing I notice is that we are reaching the 0.60 level underneath, which is a large, round, psychologically significant figure.

- All things being equal, the 0.60 level is an area that has been important more than once, and I do think that it is probably only a matter of time before we get some type of reaction.

- I do think that there is potential for a bounce from here, but that does not necessarily mean that I am bullish of the New Zealand dollar.

Top Forex Brokers

Federal Reserve and Bond Markets

The Federal Reserve recently cut interest rates by 50 basis points, but then again, so did the Reserve Bank of New Zealand. Furthermore, we have seen the 10-year yield in the United States rise, and that of course has thrown a monkey wrench into the plans of most market participants. The markets of course are reacting to the fact that yields have been rising, so it does make the US dollar stronger in general. After all,” money tends to go where it is treated best.”

If we do break down below the 0.60 level, then it opens up a deeper correction. This will be especially true as soon as we break down below the 0.5980 level, it’s likely that we would see the market drop down to the 0.59 level rather quickly. After all, the market is likely to continue to see a lot of questions asked about global growth and risk appetite in general, which of course the New Zealand dollar needs to continue to strengthen. This has been a brutal sell off, but at this point in time it looks like it’s getting ready to continue to the downside.

Quite frankly, this point in time I don’t have any interest in buying this pair, but if we were to break above the 200 Day EMA which sits near the crucial 0.61 level, then I would have to at least reconsider the entire idea of the trend when it comes to the Kiwi dollar.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.