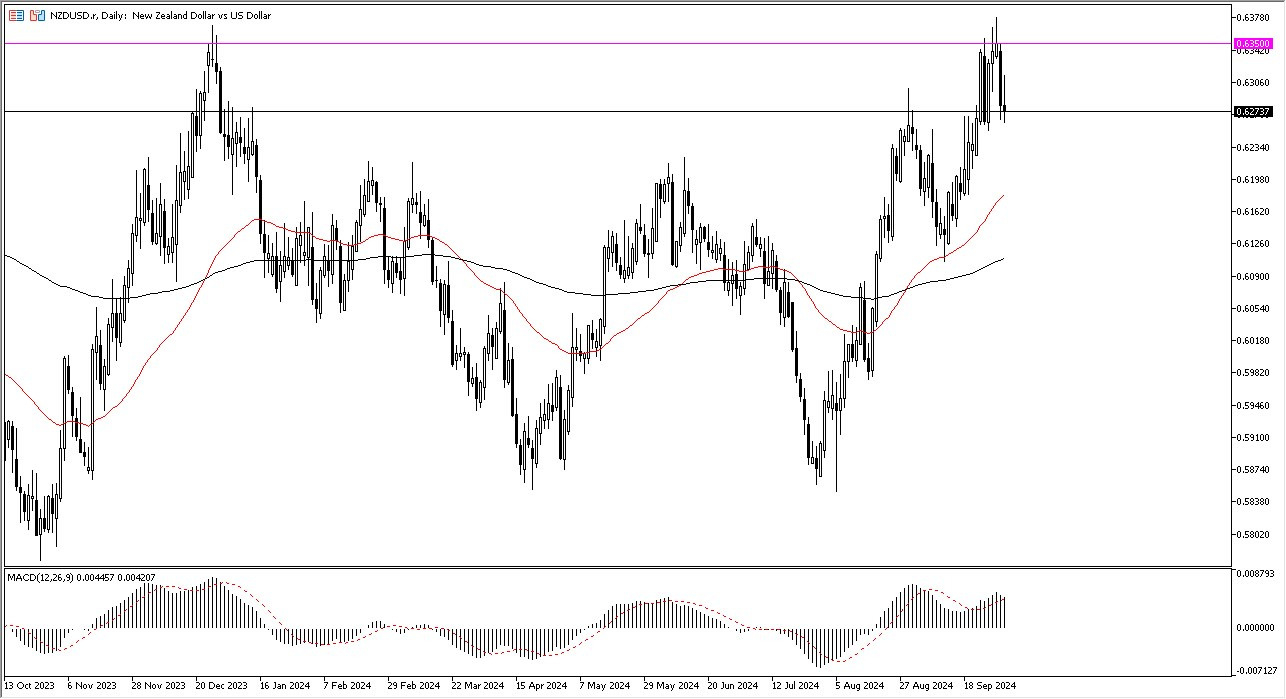

- The New Zealand dollar initially did try to rally during the trading session on Wednesday but then turned around to show signs of exhaustion.

- With that being the case this is a market that I think probably continues to see a lot of volatility.

- That makes a certain amount of sense considering that the US dollar is considered to be a safety currency while the New Zealand dollar is considered to be a commodity currency, and therefore a currency that is more for those willing to engage in risk on behavior.

Furthermore, New Zealand is highly sensitive to Asia as most of its agricultural commodities leave the islands and head to mainland China, places like that. So with all of that being said, this is a market that I do think has plenty of support underneath, near the 0.62 level and the 50-day EMA. If we break down below there, then I think we test the 200-day EMA.

Top Forex Brokers

There are buyers below

On the other hand, if we turn around and break to a fresh new high, then it opens up the possibility of the New Zealand dollar going to the 0.65 level. Remember, the Federal Reserve recently cut interest rates by 50 basis points, and that's been part of what has been so negative for the greenback. However, when you look at the chart, you can see just how stretched we are. And therefore, I don't think it's going to be easy to break out to the upside. And quite frankly, we would need to see some type of fundamental reason for things to change. As things stand right now, when you look at this chart, you can make a serious argument for the 0.6350 level as being a ceiling in what is a major long-term consolidation range. If that’s the case, this is a market that I think will continue to be noisy, and because of this, I will be cautious with my position size.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.