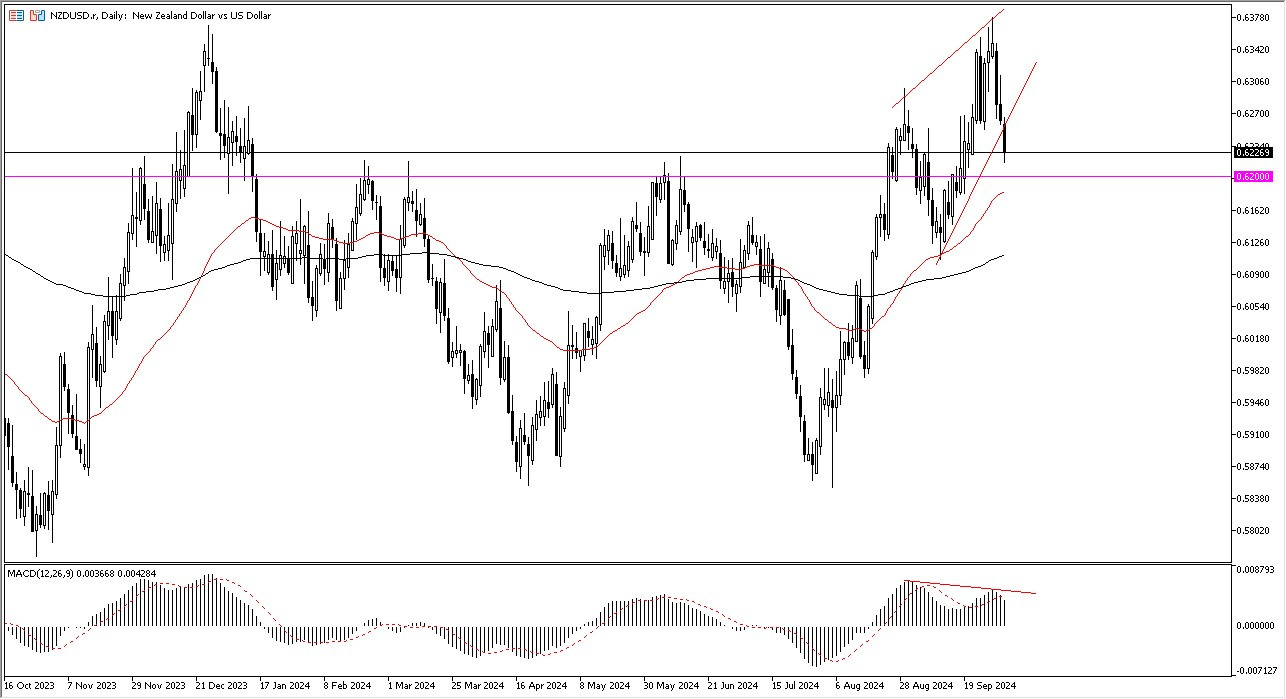

- The New Zealand dollar broke down a bit during the course of the trading session on Thursday, as it looks like we are going to reach towards the 0.62 level.

- The 0.62 level is an area that previously has been resistant, and therefore it should have a certain amount of support.

- Furthermore, we also have the 50-day EMA coming into the picture so, I think you have to look at it through that prism also.

All things being equal, if we break down through all of that, then we go much lower. It's interesting that we had formed a rising wedge, broke through it, and the divergence and the moving average convergence divergence indicator all lines up for a potentially negative signal and a lot of this I think is going to come down to risk appetite.

Risk Appetite and the NZD/USD Pair

Risk appetite being strong or weak will be a question. And therefore, I think you need to pay close attention to the reality that the markets are very skittish at the moment. And I think that with this being the case, it does give the US dollar at least a reasonable chance to strengthen. Keep in mind that the Kiwi dollar is considered to be a commodity currency. It's mainly soft commodities and it of course is highly sensitive to Asia.

Top Forex Brokers

So, with that, I think we have a scenario where things will continue to be very noisy, but I would keep an eye on the 50 day EMA more than anything else, as it is likely a signal as to where we go for the next several handles. At this point, I believe that the market will continue to see a lot of volatility so you should be cautious about your position sizing. This is generally true under the best of circumstances, so I think you have got a situation where traders will continue to look at this currency pair as a risk barometer, but also a nice range bound trade before it's all said and done.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.