- The silver market caught my attention during my daily analysis of commodities on Thursday as it continues to show extreme amounts of volatility.

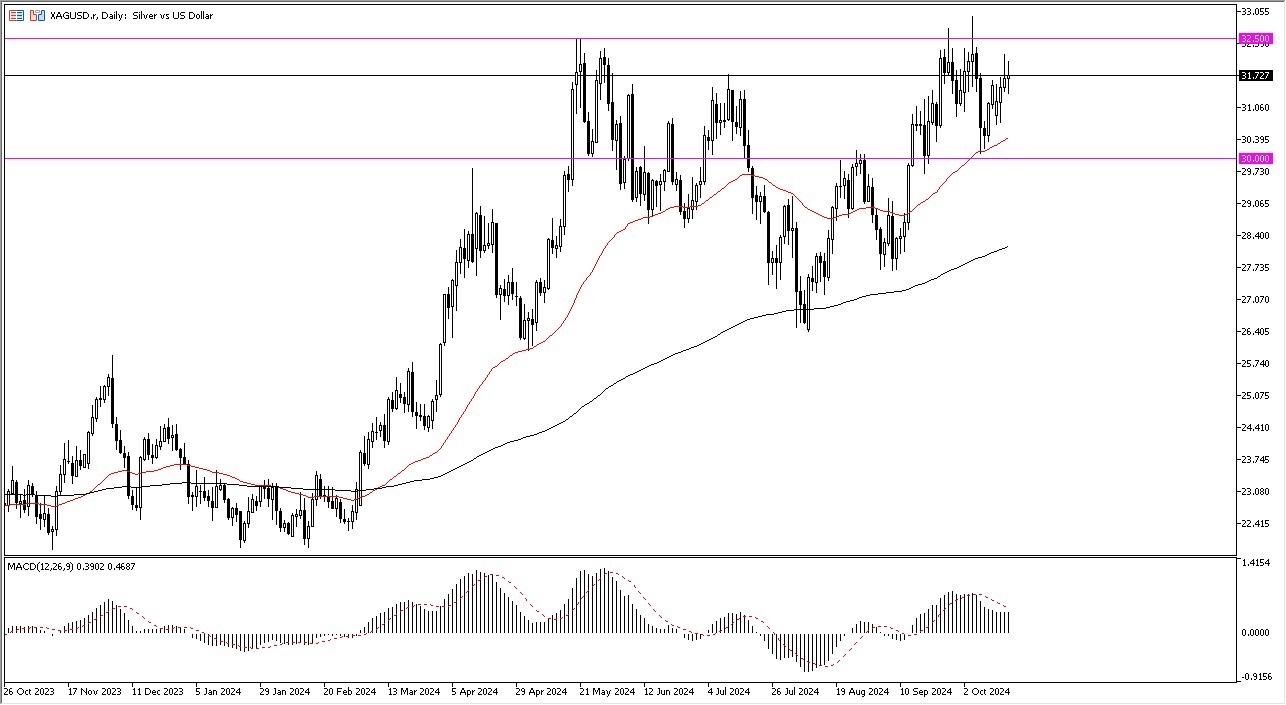

- At this point in time, I think that it is only a matter of time before we go looking to the $32.50 level above, which is an area that has been massive in its implications as resistance.

- After all, we have reached that level a couple of different times, and therefore I think traders will continue to look at that as a major barrier to overcome.

If and when we do overcome that barrier, I think that it will release a lot of inertia in this market and send silver roaring to the upside. Breaking above the $32.50 level opens up the possibility of a move to the $35 level eventually. I think short-term pullbacks continue offering buying opportunities, because we have a massive amount of support just below.

Top Forex Brokers

Volatility is second nature for silver

Volatility is a feature of the silver market, as the market is like gold, but at the same time it’s worth noting that the silver market is a much bigger contract, so you can get really hit hard if the market continues to see massive swings. After all, you need to be very cautious with your position size, and that is the most important thing that I can tell you about silver.

That being said, the market is likely to continue to see a lot of back and forth between the $30 level underneath and the $32.50 level above. Furthermore, you should also keep in mind that the 50 Day EMA currently sits right around the $30.40 level and is rising. This of course is a dynamic support level that a lot of people will be paying attention to, and therefore I do think that eventually we do have buyers jumping into the market. All things being equal, silver moves on interest rates, the US dollar, and of course the idea of demand when it comes to green energy and green technologies.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.