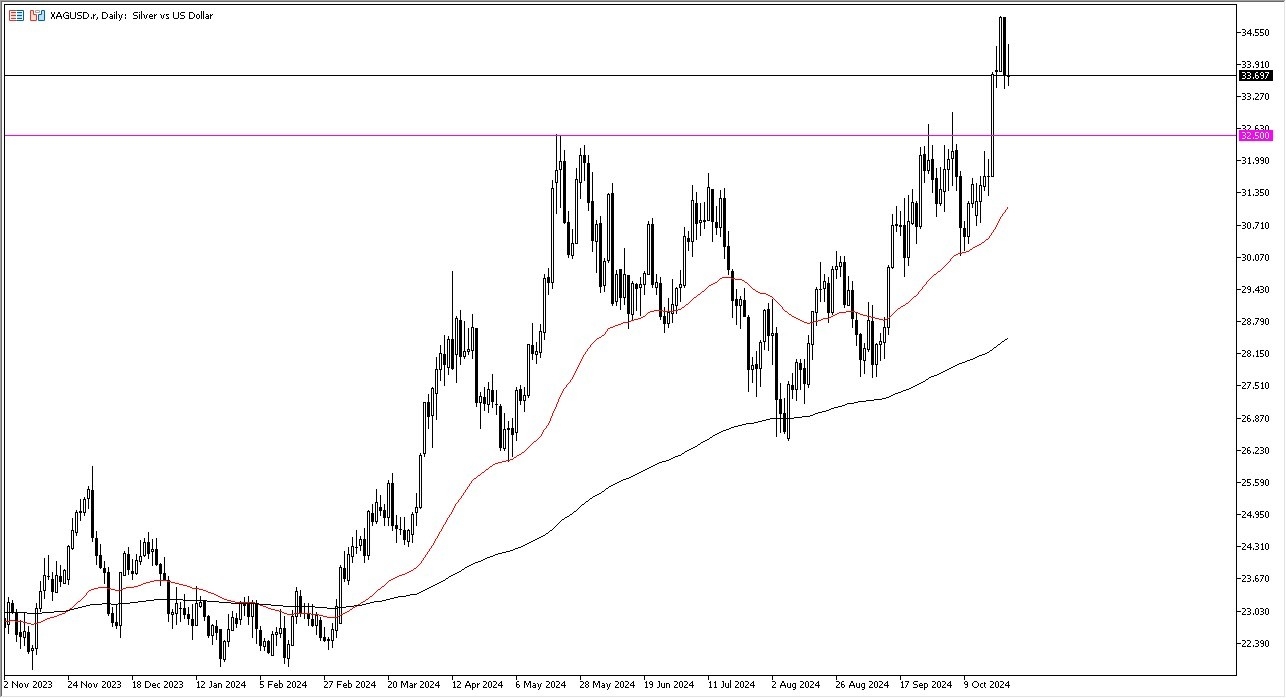

- Silver continues to see a lot of volatility as we initially rallied during the trading session on Thursday only to give up gains at this point in time.

- The market continues to see a lot of noisy behavior, and I think ultimately, I think even if the market breaks down from here, there is plenty of support just waiting to come into the picture.

- The market will continue to see a lot of noise, but it obviously a very bullish attitude that we see at the moment.

The Major Support Level

The $32.50 level is an area that previously had been resistant, and therefore I would anticipate that there should be a significant amount of market memory in that neighborhood to keep the market afloat if we do fall that far. Silver got way ahead of itself, and after the viciously negative candlestick on Wednesday, it would not be overly surprising to see a little bit of a pullback, but that pullback should end up being something akin to offering value at this point in a market that is overdone.

Top Forex Brokers

Silver is extraordinarily volatile under the best of circumstances, and therefore you need to pay close attention to how the risk appetite around the world is going. Furthermore, silver is also sensitive to interest rates.

So, if interest rates start rising, a lot of the time will actually work against silver. And that might be part of what we had seen during the trading session on Wednesday, because we do continue to see the 10-year yields rising in America, defying the Federal Reserve in what they had recently done. Furthermore, you also need to look at the geopolitical situation. Perhaps geopolitics will come into the picture and people will look for hard money, such as gold and silver. And finally, you also have to pay attention to the industrial use case, which of course is something that's a bit in flux.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.