- Silver has been all over the place on Friday and that's not a huge surprise considering that the market has been very volatile to say the least.

- Keep in mind also that the non-farm payroll numbers came out hotter than anticipated.

- So, there's been a little bit of push and pull in this market. Not a huge surprise.

Fridays tend to be volatile, as trading continues to focus on a while plethora of reasons. Furthermore, the market players will often get flat heading into a weekend, as the news flow can cause major issues.

Top Forex Brokers

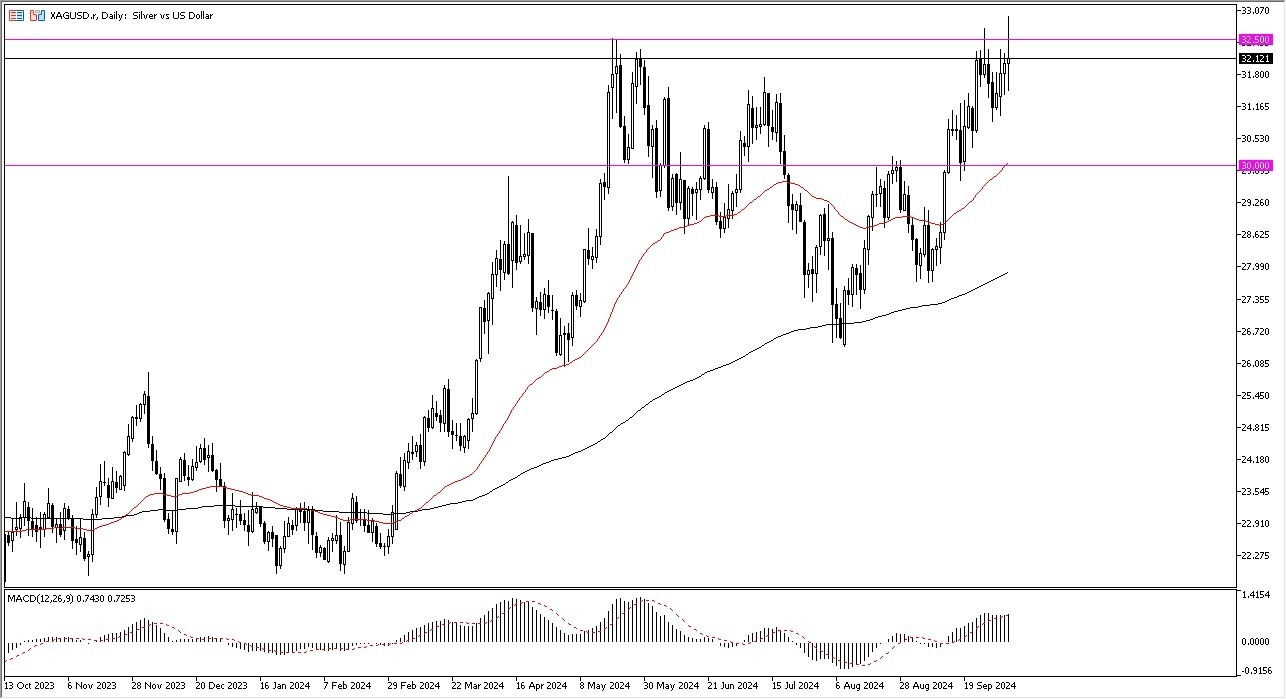

When you're talking about the non-farm payroll Fridays, that makes it even messier. So, at this point in time, I think you've got a situation where you have to look at this through the prism of short-term pullbacks being buying opportunities. We did pierce that crucial $32.50 level, but it was not enough to continue. I think this comes down to the non-farm payroll numbers coming out hotter than expected and making people think a couple of different things at the same time. One thing is that demand should pick up if there is still a strong employment situation in America. This could impact the idea of where commodities go over the longer-term.

Maybe the Move Makes Sense

It would make a certain amount of sense that the demand for goods, especially higher end goods might still be strong, but at the same time, it also suggests that perhaps interest rates will have to stay a little hotter than anticipated, and that could drive down the desire for traders to hold precious metals. I think at this point in time, really what you're looking at is a failed breakout for now, and that would be the big point here is the two words for now. I do think eventually we break out to the upside, and short-term pullbacks should continue to attract buyers.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from