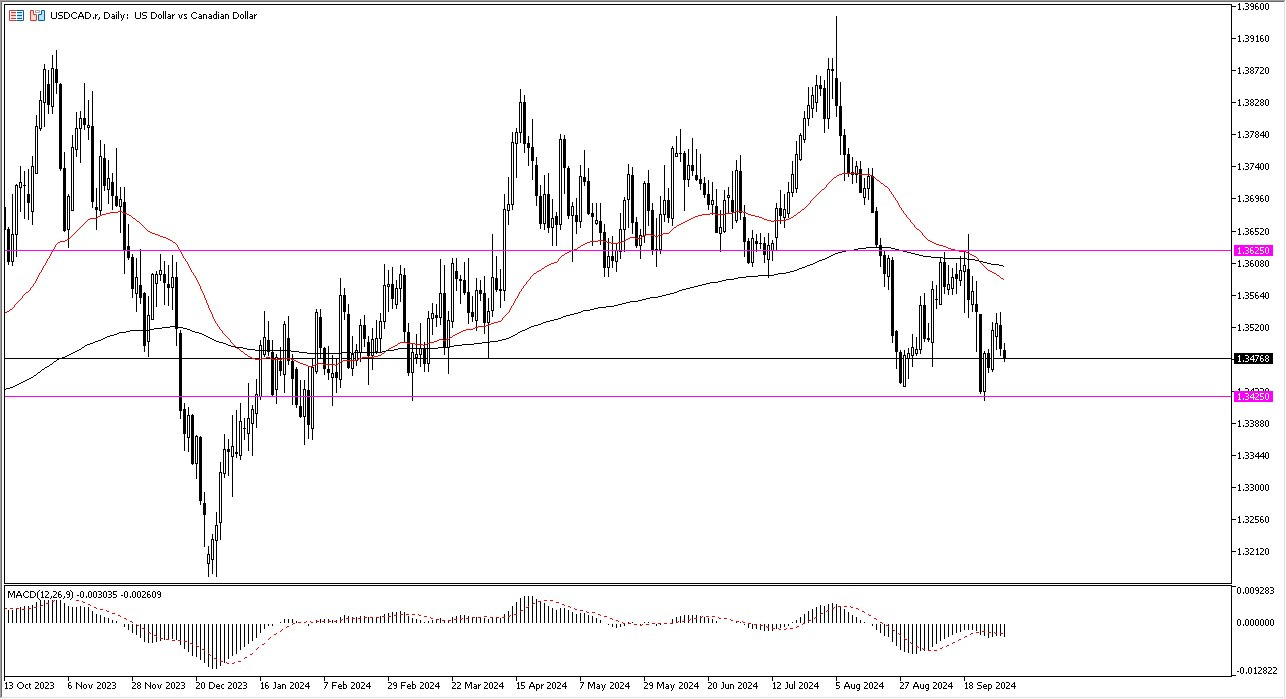

- During my daily analysis of major currency pairs, the USD/CAD pair captures my attention due to the fact that we are heading toward a major support level.

- When I look at the chart, the 1.3425 level is an area where we have a lot of interest, based on the historical price action.

- All things being equal, I think this is an area where we will see a lot of interest based on technical analysis, if for no other reason than that.

The Moving Average Convergence Divergence indicator is showing signs of divergence from price as well, so it’ll be interesting to see if we do get a positive bounce. Quite frankly, most of what we have seen coming out of the Canadian dollar comes to the idea of the crude oil markets rally in. All things being equal, this is a situation where the oil markets will have somewhat of an influence on the USD/CAD pair, but keep in mind that the United States is also a major producer of crude oil, so it doesn’t have as much of an influence as it used to.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is somewhat negative, but we have a lot of support underneath that a lot of people will be paying attention to. If we were to break down below the 1.3425 level, then I think you’ve got a situation where the US dollar could drop down to the 1.33 level. On the other hand, if we turn around and show signs of strength, breaking above the 1.3250 level opens up the possibility of a testing the 50 Day EMA, the 200 Day EMA, and then finally the 1.3625 level after that.

If there is a certain amount of risk aversion out there, I think we got a situation where the US dollar will be a big winner over the Canadian dollar. Quite frankly, this is a scenario where if we were to break above the 1.3625 level, then I think the US dollar really start to take off again. You would probably see a lot of other assets falling in that move because the US dollar of course typically gains at the losses of other assets.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.