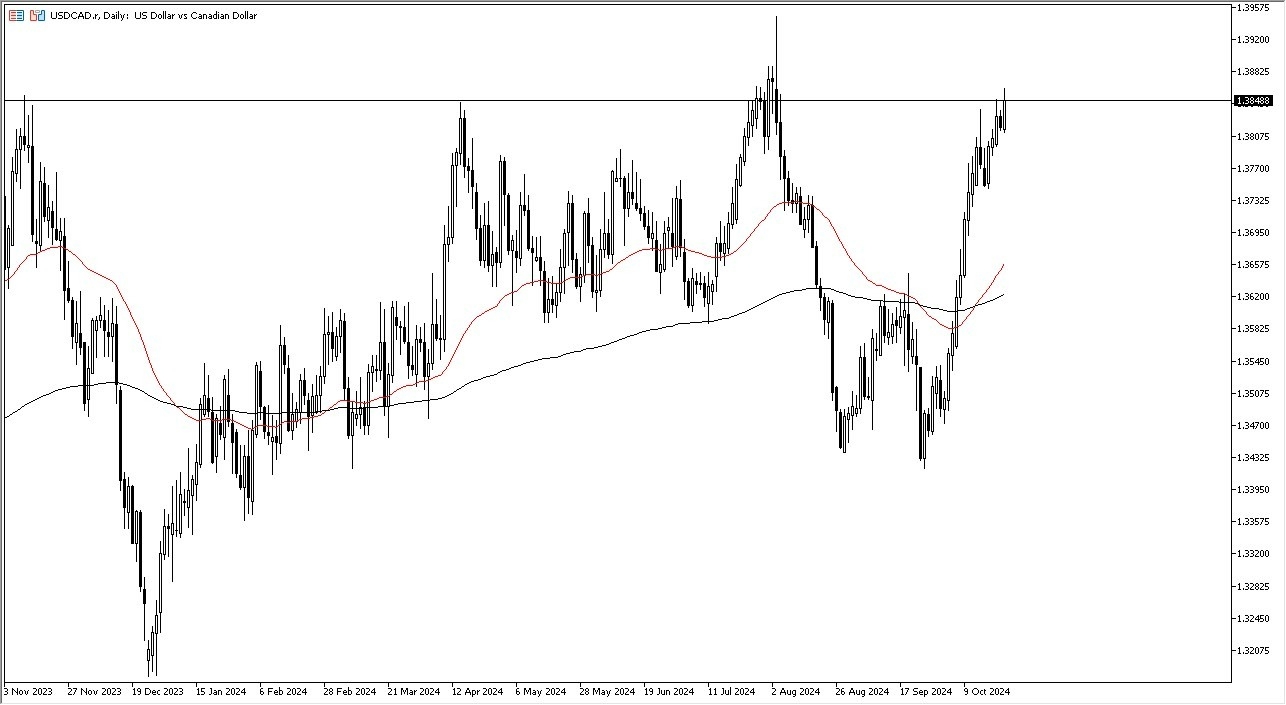

- In my daily analysis of the USD/CAD pair, the US dollar continues to show its strength, as we are certainly overextended, but recently had seen a little bit of consolidation that might lead to more renewed confidence in pushing the US dollar higher.

- After all, markets can’t go forever in one direction, but we had spent about a week or so grinding back and forth near the 1.38 level and it now looks as if the market is tentatively trying to take off to the upside.

Speaking of that previous consolidation area, I suspect there is a certain amount of support near the 1.3750 level, as it was the bottom of that range. As long as we can stay above that level, I would anticipate that the market should continue to go higher, perhaps trying to get all the way to the 1.40 level over the longer term. This isn’t to say that the move would be quick, because quite frankly the 2 economies are so heavily intertwined that this pair tends to be choppy at best. Anybody who has tried to cross the Ambassador British, or the International Peace Bridge can tell you firsthand just how much trade goes between the 2 countries.

Top Forex Brokers

Crude Oil Doesn’t Matter Anymore

Quite frankly, though crude oil market used to be a major driver of what happened in this pair, but as the United States regularly flirts with producing 12 million barrels a day, this is no longer a petrol currency pair. Both of these countries produce an enormous amount of crude oil, so although the Americans do guzzle down quite a bit of Canadian crude, the reality is that it is only a portion of the trade between these 2 massive economies.

The Bank of Canada has recently cut rates rather aggressively, but so has the Federal Reserve. Quite frankly, if the US economy does in fact start to slow down, that’s not a good thing for Canada. Quite frankly, Canada needs the United States to have its own healthy economy. This is akin to Canada being a merchant, and the United States being its biggest customer. As things stand right now, it looks like dips will continue to attract buyers.

Ready to trade our daily forex forecast? Here are the best Canadian Forex brokers to start trading with.