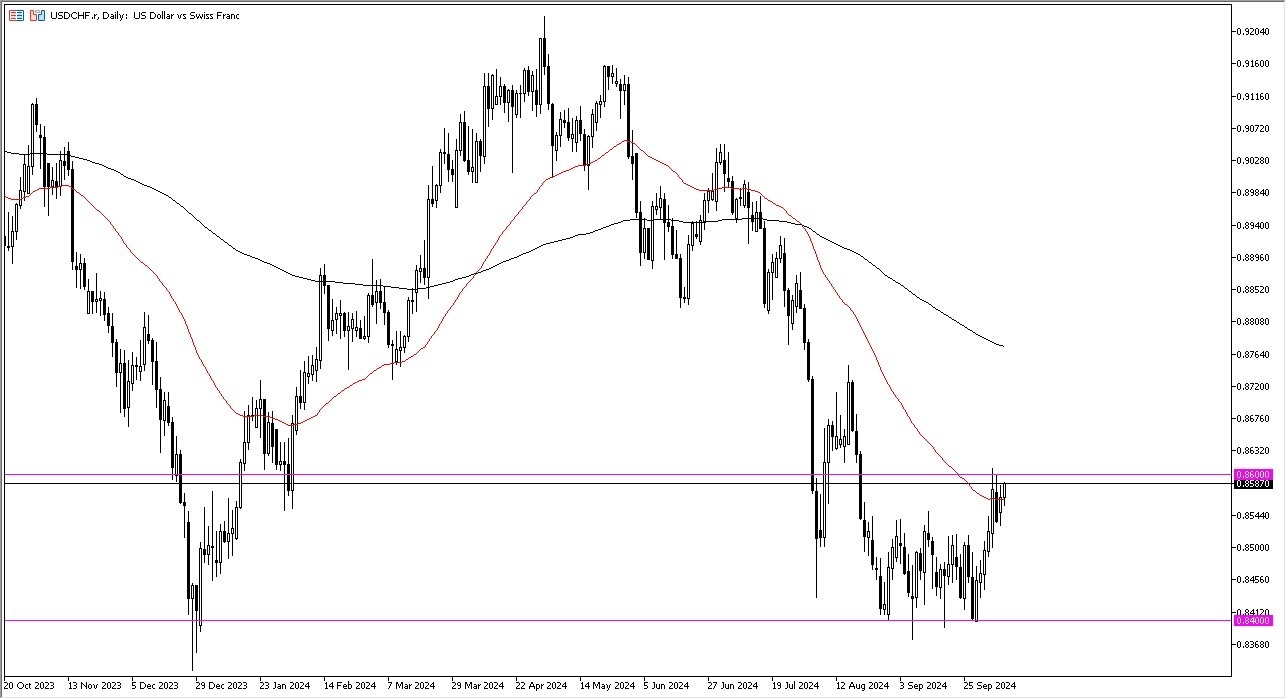

- During my daily analysis of the USD/CHF pair, the first thing I notice is the 0.86 CHF level, which is crucial as we have seen it offer resistance multiple times.

- With that being said, the market is likely to continue to see a lot of volatility and questions as to this area, but this is an area that I’ve been watching for a while so obviously, I am paying close attention now.

Technical Analysis

The 0.86 level continues to be important, and I look at that as a gateway to much higher pricing. Furthermore, we are breaking above the 50 Day EMA during the trading session, and it does suggest that we are starting to see a little bit of upward momentum. If we were to break above the 0.86 level, it could open up a move to the 0.8720 level. That’s an area that was a recent swing high, so I think a certain amount of market memory could come into the picture, and therefore it could offer a target, but it can also offer quite a bit of resistance.

Top Forex Brokers

On the downside, the 0.8550 level is an area that has offered support multiple times, as it had been in previously resistive. In general, I think this is a scenario where the market has been trying to find its flooring, and I think at this point it looks like the 0.84 level is a very real possibility of being that. This is not to say that the market will simply take off to the upside, but I do think that you have a real possibility of a market that may have just found its floor in the intermediate term, possibly even the longer term.

All things being equal, I like the idea of buying short-term dips, as it offers value and the US dollar. Keep in mind that the Swiss franc is considered to be a massive “safety currency”, even more so than the greenback. Because of this, the pair is ever so slightly “risk on” if it goes higher.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.