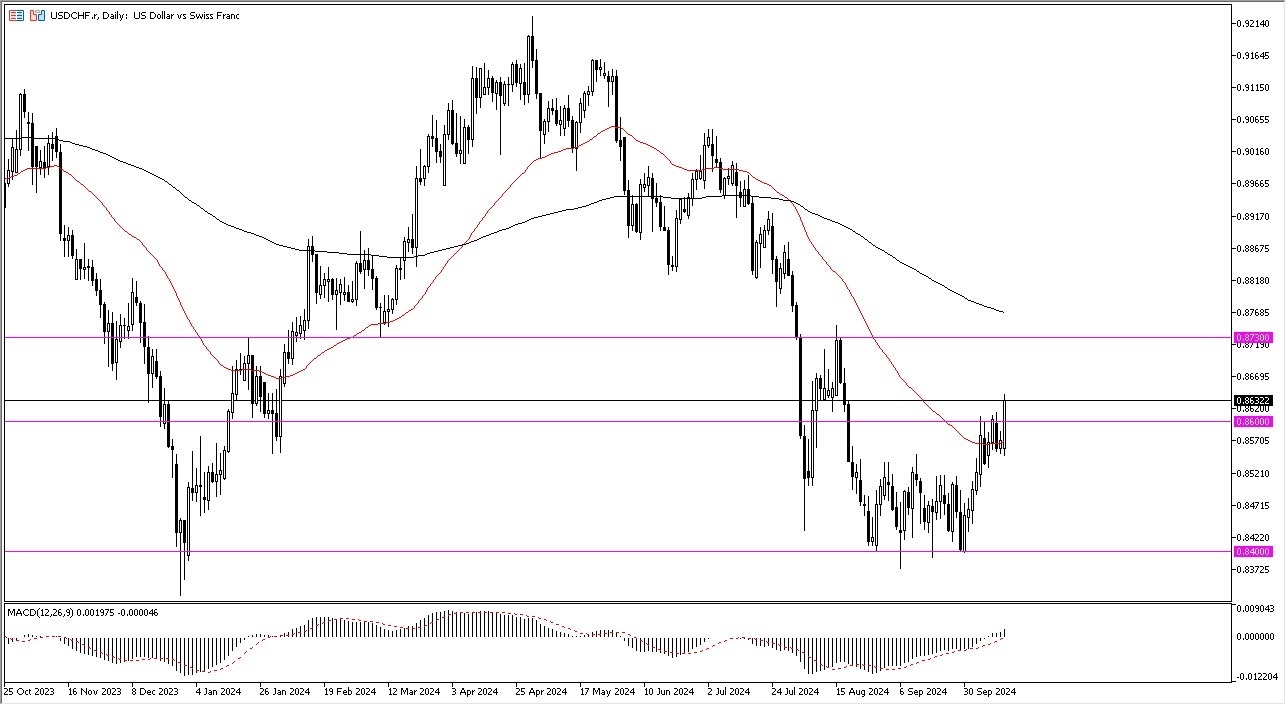

- The US dollar has rallied significantly against the Swiss franc during the early hours on Monday, as we have broken above the crucial 0.86 level.

- The 0.86 level is an area that a lot of people have been paying attention to for the last couple of weeks, and now that we have broken above this area, it's likely that we could continue to go higher, perhaps looking to the 0.8730 level, which was a swing high.

- The size of the candlestick is rather impressive and that tells me that we probably have continued momentum just waiting to happen.

With that, I am a buyer of short-term dips, although full disweclosure, I'm already long of this market as of the breakout. This is a market that I have been watching for a while, and I think we could be in the process of trying to turn things around.

Top Forex Brokers

On a Break Higher in this Pair

The market breaking above the 0.8730 level is a very strong sign. And I suspect that if we get to that area, we will probably be threatening the 200 day EMA as well. That of course is an indicator that a lot of people pay close attention to. All things being equal, short-term pullbacks I think will continue to be interesting. Unlike a lot of the Swiss Franc related pairs, this one, actually will move higher in the favor of the US dollar because it is considered to be riskier than the Swiss franc.

While most people think about the British pound against the Swiss franc in a risk on trade, this is actually one as well. Keep in mind, the interest rate differential does pay you at the end of every day to hold the green back against the franc. So, I think that works in its favor as well, given enough time. This is a slow moving market overall, but at this point in time, the market looks as if it is trying to go much higher.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.