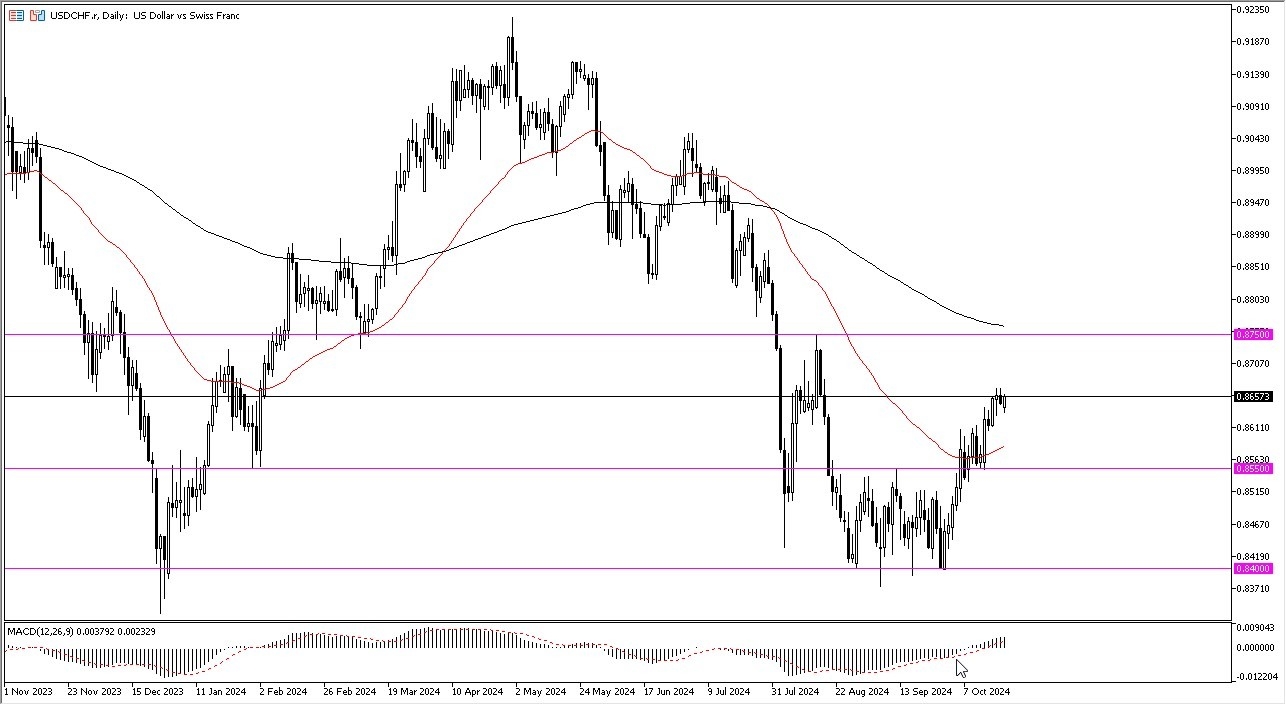

- The US dollar has rallied against the Swiss franc yet again during the trading session on Monday as it looks like we are trying to break above the 0.8650 level for a bigger move.

- At this point in time, the market is likely to go looking to the 0.8750 level, an area that previously had been significant resistance.

- We also have the 200 Day EMA in that area as well, so therefore it’s worth noting that the market will certainly see a certain amount of “market memory” in this area, so I do think that it will continue to be somewhat noisy.

If we were to break above that level, then I think the US dollar can go much higher, but in the short term I do think that we are a little bit extended.

If we were to break above that level, then I think the US dollar can go much higher, but in the short term I do think that we are a little bit extended.

Top Forex Brokers

Some sideways action is probably more likely than not. The currency pair is currently trading about halfway between the 50 Day EMA underneath and the 200 Day EMA above. You can track the movement on the USD/CHF live chart, as we expect continued pressure in both directions, a pattern that has repeated each time we've traded between these moving averages.

Technical Analysis

Now that we are well above the 50 Day EMA, I think a lot of focus will be sent toward the 200 Day EMA, which of course is a longer-term technical indicator.

Breaking above that opens up the next leg higher, and I think we would see the US dollar really start to take off against most currencies in that environment. However, you should also keep in mind that this market rising would be essentially a “risk on move”, as the Swiss franc is considered to be a major “safety currency.”

In general, I think this continues to be very noisy, but I think given enough time we will continue to see markets move in one direction overall when it comes to risk appetite, so pay attention to stock markets as they can give you a bit of a “heads up” as to where this market will end up.

Ready to trade our daily Forex analysis? We’ve made a list of the top brokers in Switzerland for you.