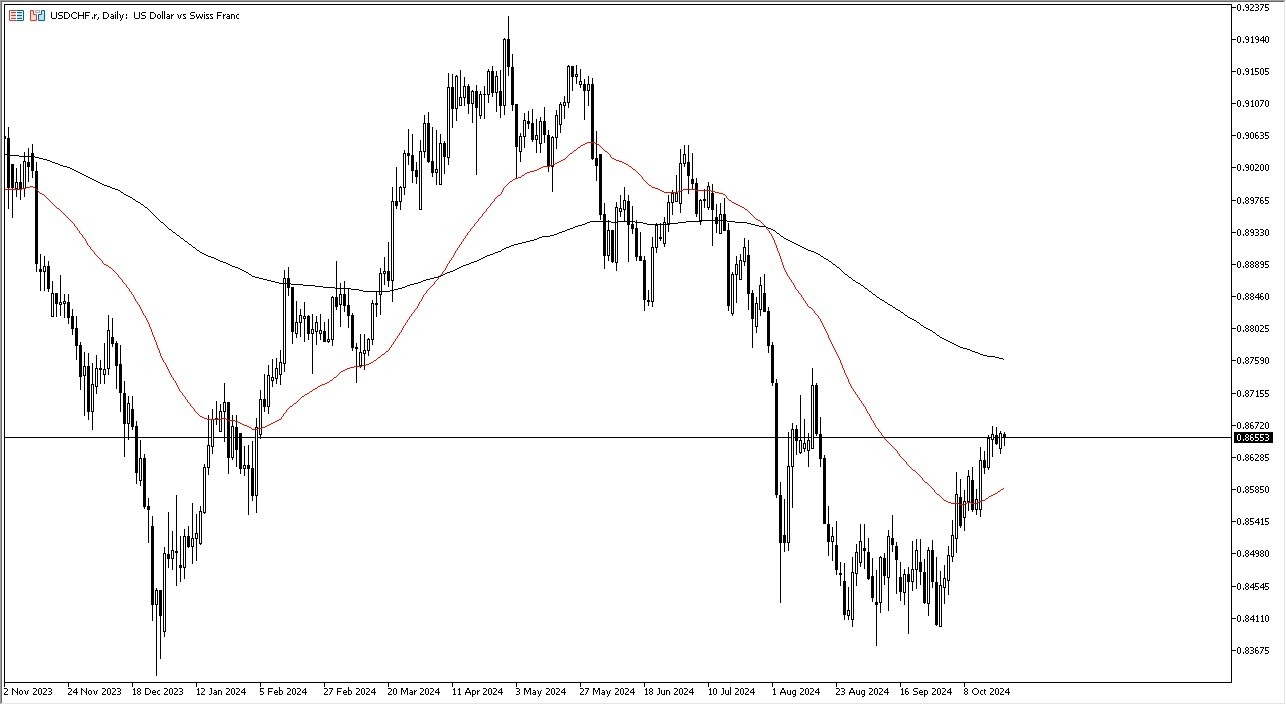

- The US dollar has been all over the place in my daily analysis, and as for the USD/CHF pair is concerned, it’s obvious that we are at the top of a strong move.

- It’s worth noting that the 0.8650 level has been a bit of a barrier over the last several days, and I think if we can break above there it’s likely that the market could go much higher.

- Ultimately, at that juncture, I would expect that we would go looking to the 200 Day EMA, closer to the 0.8750 level.

On the other hand, if we were to pull back from here, I think that the 50 Day EMA comes into the picture near the 0.8575 level, as a potential dynamic support level. Anything below there could open up a deeper correction down to the 0.8550 level. However, I do think that there is enough support in momentum to the upside that we need to keep this bullish attitude in mind.

Top Forex Brokers

Technical Analysis

Now that we are between the 50 Day EMA and the 200 Day EMA, you quite often will see a bit of a “squeeze in the market” as traders try to determine where the longer-term trend is going to end up. I would postulate here that the 0.84 level is a massive amount of support just waiting to happen, as it goes back several years as being important. The fact that we have bounced so hard from there should not be a huge surprise, and now I think we are in the process of trying to turn things around and have a longer term uptrend.

In the last couple of days, we have seen rates spike in the United States in the bond market, so that does keep a little bit of a bit in the US dollar. Ironically, this is one of the few pairs that the US dollar strengthening is actually a potential “risk on” signal, because the Swiss franc of course is considered to be “ultimate safety.” As things stand right now, I like the idea of buying dips going forward.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out