- The U.S. dollar has been fairly quiet against the Swiss franc during early hours on Tuesday, as we continue to see a lot of questions asked about the overall trend.

- Keep in mind that the interest rate differential does favor the U.S. dollar, and with the recent action in the bond markets, it makes quite a bit of sense that the US dollar continues to climb against the Swiss franc as the Swiss franc is considered to be a major safety currency.

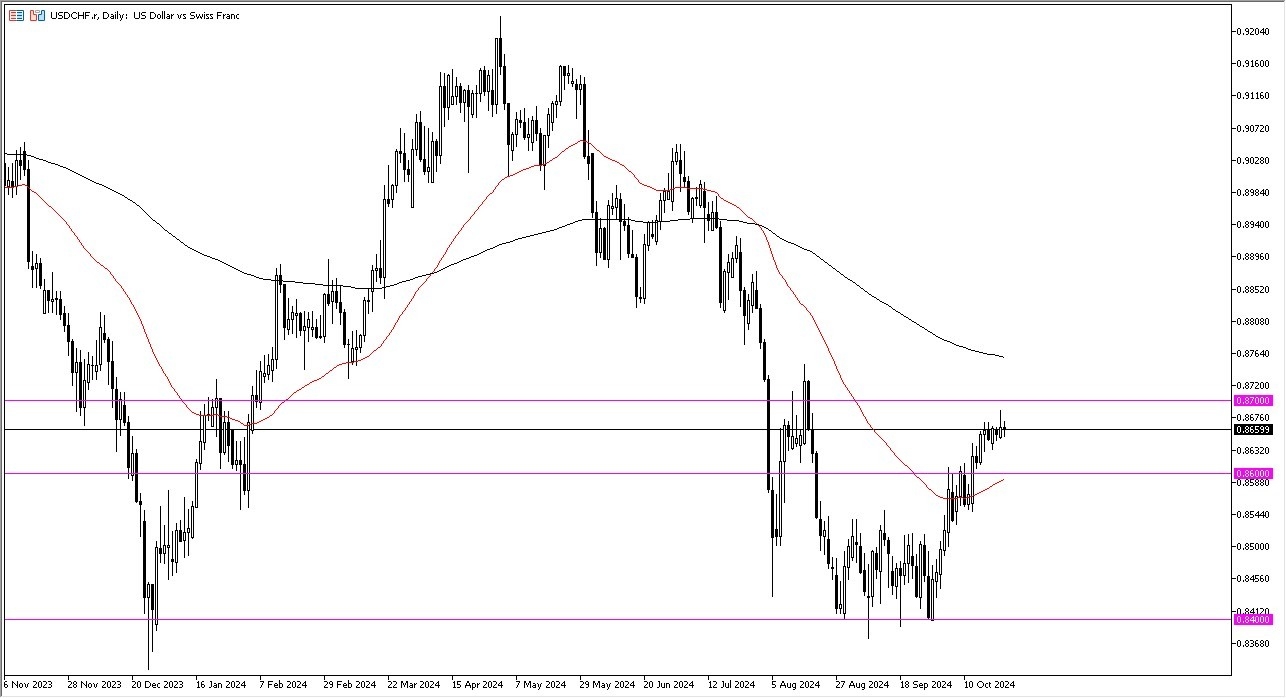

- That being said, I think you also have to pay close attention to the 0.87 level because the 0.87 level is where we had seen a swing high previously. The question now is whether or not we can continue to go higher.

Short Term Pullback Possible

Top Forex Brokers

A short-term pullback is most certainly possible after the PMI numbers are released. But I think you've got a scenario where the 50-day EMA and the 0.86 level is likely to be a bit of a short-term floor in the market. Then after that, we have the 0.84 level. This is a market that I think is a hard basement floor in the market. This an area that I think will continue to be important for most traders, and as a result, we are going to have to pay close attention to the level.

This is an area that's been important multiple times, and therefore it's not a huge surprise to see how we have behaved. Nonetheless, I think each dip probably offers an opportunity to pick up a little bit of value. And if we can break above the 0.87 level, then we've got the possibility of the 200-day EMA above offering a target, and anything above there actually technically flips the entire trend. I do think eventually that's what you'll see, but this is a grinding pair most of the time, so keep an eye on that.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.